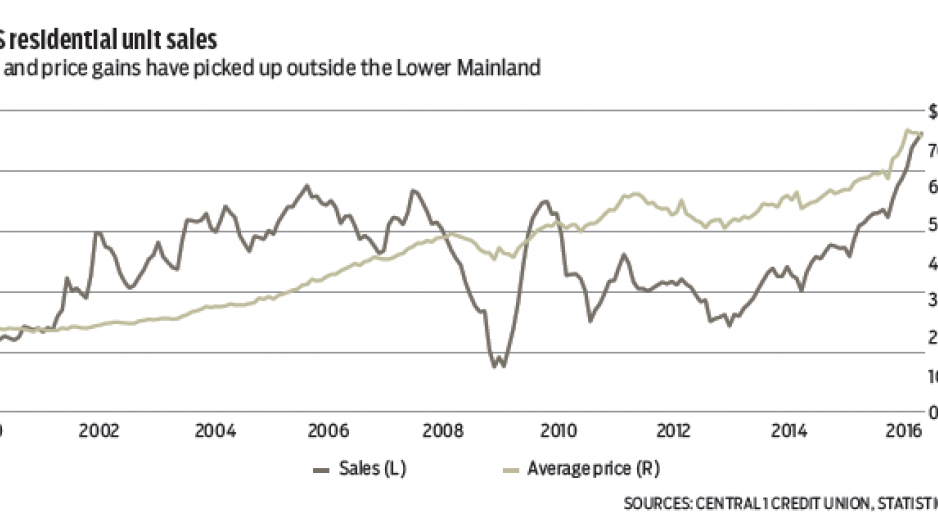

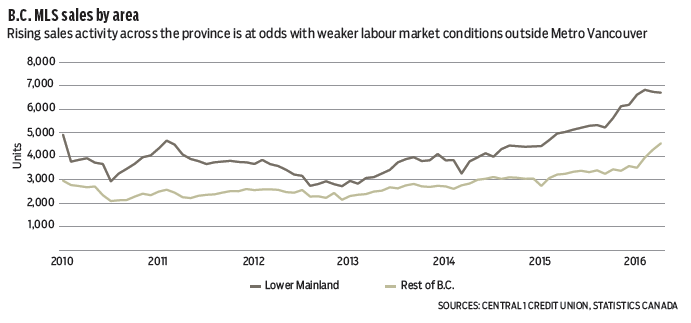

While home sales in the Lower Mainland took a slight breather in April, stronger demand elsewhere in the province picked up the slack to drive home sales up 2% from March to a seasonally adjusted 11,245 units – a 36% gain from a year ago.

Among regional real estate board areas, monthly gains were highest in Kamloops (23.9%), northern B.C. (10.3%) and the Okanagan (7.7%).

With a series of month-to-month gains in a number of regions outside the Lower Mainland, it would seem that the robust demand cycle in the Lower Mainland has spread its wings to span the broader market, particularly on Vancouver Island and in the southern Interior.

The northeast remains a weaker link due to the economic impact of low commodity prices. It posted a sharp decline in sales, although monthly figures are volatile given small sales counts in the area.

Market conditions remain tightest by far in the Lower Mainland, with sales-to-

active-listings ratios pointing to a lack of supply in the region and high prices as the likely causes of constrained sales growth.

Elsewhere, the positive sales cycle is outpacing new listings to create broadly balanced market conditions, although seller’s markets are seen on the Island and the Kelowna-centred region.

Rising sales activity across the province is at odds with weaker labour market conditions outside the Lower Mainland and, to a lesser extent, the Island.

However, the persistence of low mortgage rates, the ripple effect of homeowners in Metro Vancouver cashing out on massive housing equity gains, and individuals looking to relocate to more affordable locations could very well be providing the uplift to regional communities. Retiree inflows are also likely drivers of demand in larger urban markets.

The Multiple Listing Service average price fell 1.3% from March to a seasonally adjusted $731,481 but remained 18% above a year ago. The monthly decline reflects a higher share of sales in lower-priced regions in April, as most board areas (including Greater Vancouver) posted a gain. •

Bryan Yu is senior economist at Central 1 Credit Union.