Premium Brands Holdings Corp. (TSX:PBH) has steadily expanded its high-end food manufacturing and distribution sales through boom years and recessionary times and is poised to kick growth into high gear.

The Vancouver-based company closed the largest acquisition in its 94-year history in September when it spent $102.7 million to buy Ontario-based Piller Sausages & Delicatessens Ltd.

Premium has made more than 40 acquisitions in the past decade. Recent purchases include:

•Les Aliments Deli Chef from Canada Bread Co. Ltd. (TSX:CBY) for about $8 million in February;

•Seattle’s FK Food Group Inc. for $42.5 million in October 2010;

•Nanaimo’s HUB Fisheries for an undisclosed amount in late 2010; and

•a 76% stake in Toronto’s Maximum Seafood for an undisclosed amount in July 2010.

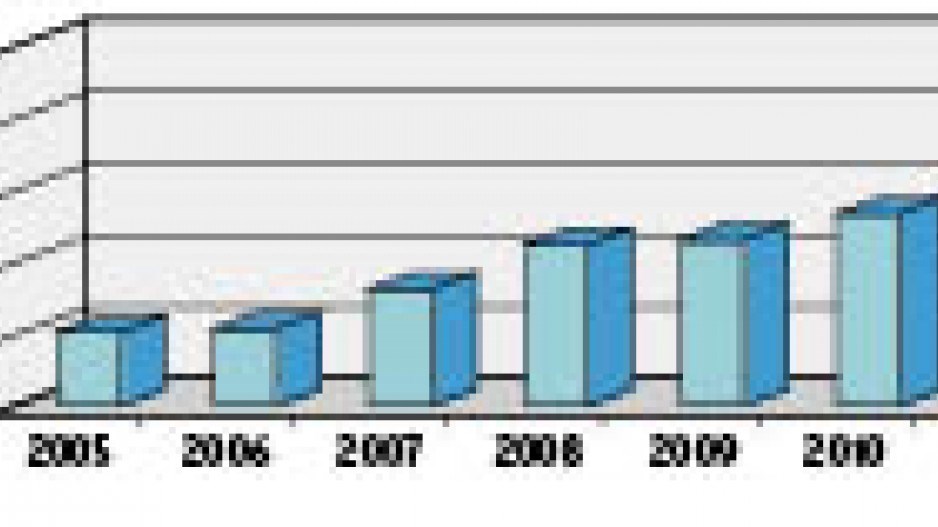

The transactions combine to enable Premium Brands to generate revenue at a rate of roughly $900 million annually, or about 68% more than the $535.3 million the company generated in 2010 – its best year thus far for sales.

Growth will not come exclusively from including Piller’s $180 million in annual revenue. Premium Brands has six main business segments – many of which overlap and provide opportunities to leverage sales.

The company’s overall strategy is to integrate vertically so it can produce high-end products and deliver them directly to customers.

For example, Premium Brands manufactures and delivers Bread Garden-branded sandwiches to Chevron Town Pantry convenience stores.

It also delivers protein to hospitals, restaurants and hotels.

The Piller acquisition will make Premium Brands the first national player specializing in producing and delivering high-end deli meats across Canada.

It could also increase profits because Premium Brands can reduce expenses for production, warehousing and transportation.

Piller meats sell primarily in Ontario; sales of Grimm’s Fine Foods products are focused in Western Canada.

Savings can accrue because both brands sell small amounts in the other’s bailiwick.

“When you look at freight alone, we’re talking significant dollars [to transport meat products across the country],” said Premium Brands CEO George Paleologou. “So we would look at producing some of Piller’s products out here. That would save a lot of money.”

PI Financial Corp. analyst Sheila Broughton likes the way Premium Brands is spreading its reach outside B.C., where one-third of its 2,800 employees are based.

“They have a very solid business in B.C.,” she told Business in Vancouver, “and they now want to replicate that in other geographic regions.”

For example, the company’s FK Foods acquisition included a manufacturing facility in Nevada and its Piller acquisition came with five facilities in Ontario.

“I wouldn’t say that I have a red flag on any part of their business right now,” said Broughton, who has a buy rating on the company and a price target of $21 – a 35% premium on the company’s closing price September 28.

Still, Broughton is watching closely to ensure that the company successfully integrates Maximum Seafood, which is Premium Brands’ first foray into delivering live seafood to customers.

A bigger obstacle could be the volatile economy if sagging stock markets prompt grocery shoppers to either limit their purchases of products such as high-end bacon or to buy smaller sizes.

Broughton groups grocery shoppers into one of three categories:

•people who always buy the lowest priced products;

•people who often buy name brands, but shift purchasing to products that are on sale; and

•people who buy what they want with little regard to the price.

Premium Brands’ target shoppers are in the latter two categories, and Broughton believes company sales could suffer if people in the middle category start to cut back.

“It’s not a big concern. We’ve gone through a fairly strenuous recessionary period, and Premium Brands weathered that quite well,” Broughton said.

“They don’t sell consumer discretionary items. You can’t choose not to eat in tough times. And they have a nice diversified mix – from pasta to seafood to sandwiches.” •