Mossack Fonseca’s purported point man in Vancouver is taking the Canadian government to court to quash a tax probe into his and his wife’s affairs launched in the wake of the Panama Papers leaks last year, claiming the minister of national revenue is violating their charter rights.

Frederick Sharp and his wife, Teresa, filed an application in the Federal Court of Canada in Vancouver in December 2016. Their application claims the government’s information disclosure requirements “are invalid because they were issued for the predominant purpose of establishing the applicants’ criminal liability, thus unjustifiably breaching the applicants’ rights to privacy and silence, and right against self-incrimination.”

The Sharps claim the minister issued a formal requirement to produce information in November 2016, but allege that the minister can’t use its “civil audit compulsion powers” without breaching their charter rights, including the right to be free from unreasonable search and seizure.

“There is overwhelming evidence that the applicant Frederick Sharp is being investigated by Canadian and U.S. criminal law enforcement agencies,” the application states.

Frederick Sharp claims he was contacted on June 1, 2016, by the Canada Revenue Agency’s (CRA) offshore specialized compliance team informing him that he was being audited for the taxation years of 2007 through 2015. The CRA, according to the application, told Teresa Sharp in September 2016 that she was being audited for the same years.

Although the CRA can use its civil audit powers to demand information from taxpayers, the Sharps claim that information-sharing agreements with the RCMP and international law enforcement agencies mean that such information “will now inevitably end up in the hands of criminal law enforcement, regardless of a taxpayer’s right against self-incrimination, and the right to be free from unreasonable search and seizure.”

“The applicants are being audited as a result of their involvement in business and financial structures which the commissioner of the RCMP has indicated raise ‘tremendous suggestions of criminality,’” the application states, adding that the CRA is “clearly engaged in a criminal investigation.”

Donald Martin with Martin + Associates, the Sharps’ lawyer, declined to comment about the case when contacted by Business in Vancouver. However, Martin stated in an email that portions of the application detailing how tax authorities were allegedly pressing Sharp’s associates under threat of prosecution for information about alleged tax evasion were innaccurate and included by mistake.

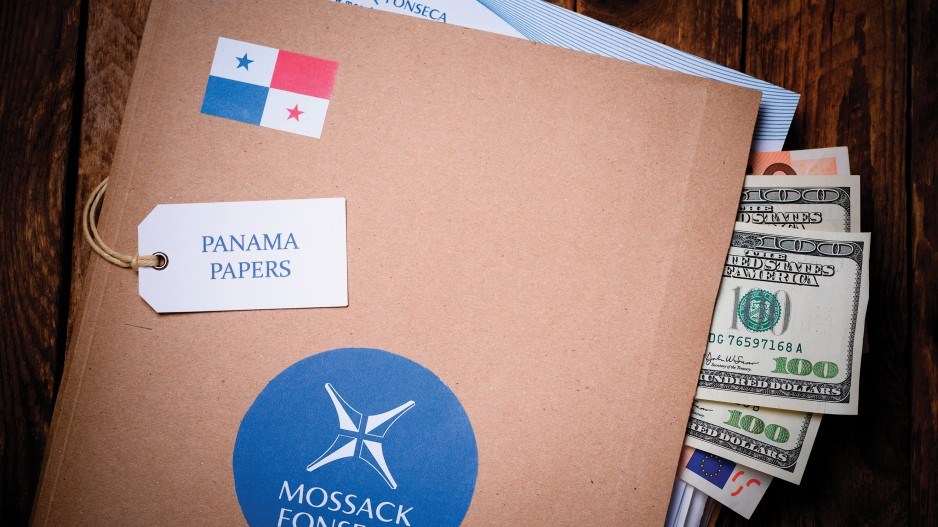

Frederick Sharp, a former lawyer and owner of Corporate House, which was used to incorporate more than 1,000 offshore companies for Mossack Fonseca’s Canadian clients, told the Globe and Mail in May 2016 that he was “tickled pink” about the publicity brought by the Panama Papers revelations but said it would be short-lived.

“I know enough that this is the flavour of the day,” Sharp told the Globe. “And it will all be forgotten next month, or whenever.”

Meanwhile, a company owned by Frederick Sharp’s brother, Thomas Sharp, filed a similar case in Federal Court in Vancouver on February 10. Thomas Sharp’s company, City Group Alliance Inc., is challenging the minister of national revenue on virtually identical grounds, claiming sections of the Income Tax Act permitting sharing confidential taxpayer information with domestic and international criminal law enforcement agencies, including the Canadian Security Intelligence Service, are unconsitutional.

City Group Alliance’s lawyer, H. Roderick Anderson with Harper Grey, declined to comment when contacted by Business in Vancouver.

David Walters, a CRA spokesman, decline to comment on the Federal Court cases, but told BIV in an email that the agency “has toughened its approach to ‘leaked lists’ of taxpayers with offshore holdings.” The CRA, Walters said, has 76 taxpayer audits underway related to the Panama Papers while investigators continue to review “extensive data.”

On February 23, the CRA announced it was on track to recover “over $13 billion this fiscal year alone from audit efforts.”