Financial experts south of the border say good on Canada for raising interest rates for the third time in less than a year.

Andrew Left, who runs the Beverly Hills-based short-selling newsletter Citron Research, was pretty frank in assessing the Bank of Canada’s move to raise interest rates to 1.25%.

“Let’s see more inflation; I love inflation,” said Left, who was a panellist at last night’s annual CFA Society Vancouver forecast dinner held at the Vancouver Convention Centre. “I think it would be a good thing, and we should raise interest rates. I believe it, for so many different reasons, obviously look around the economy is full steam, that’s when you’re supposed to raise rates, aren’t you?”

Left said one of the top benefits of raising interest rates is that people will see a higher rate of return on money currently held within financial institutions and it steers people away from riskier borrowing alternatives.

“It’s good for the savers,” he added.

Panellist Sara Shores, the managing director for BlackRock, a San Francisco-based financial planning and investment management firm, said the while the rate increase should be viewed as a good thing, it raises the prospect of inflation.

Canada’s inflation rate, which currently sits at 2.1%, is the highest it’s been since late 2014. The U.S. inflation rate is also at 2.1%, while the global inflation rate sits at 1.6%, according to the World Bank.

“That means that essentially North America is leading global inflation,” said Shores. “Elsewhere, we see less evidence of potential inflation. In Europe and Japan, we see more slack in those economies. And we expect more accommodative central banks, so we would expect short-term interest rates will remain low to negative in those markets and less inflationary pressures.”

The World Bank also recently released its latest Global Economic Prospects Report in which it predicts global growth will inch up to 3.1% in 2018. However, it noted this is primarily because of an expected 4.5% growth rate in emerging economies around the world, compared with 2.2% for advanced economies like Canada and the U.S.

She said there is one positive way to view slow, moderate growth projections around the world.

“The only silver lining there is that although global growth has been at or just above trend … expansion can continue for quite some time before it peaks. So I think our natural instinct is that we’ve been in expansion for quite some time, and we’re waiting for the shoe to drop.”

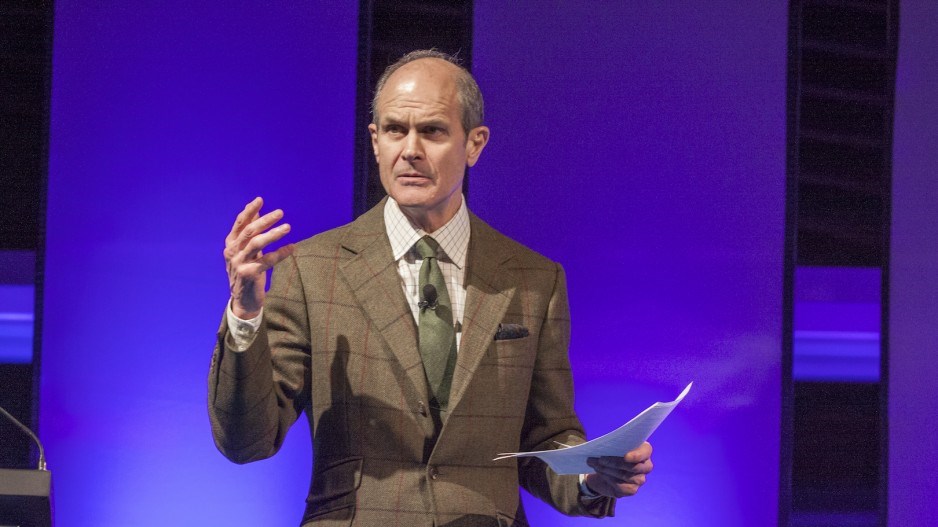

Keynote speaker Geoff Colvin, editor-at-large for Fortune Magazine, said an ideal interest rate for Canada would probably be 2%. He added that inflation has a positive impact on consumers, potentially spurring them to buy, spend and borrow now, knowing rates might soon rise again.

“What popped into my head is that this is fundamentally a good sign,” said Colvin. “I think it’s good news, and people with adjustable mortgages may be a little worried about it, but the fact is that in the big picture this is good because it suggests that the central bank thinks that the prospects for the economy are strong.”