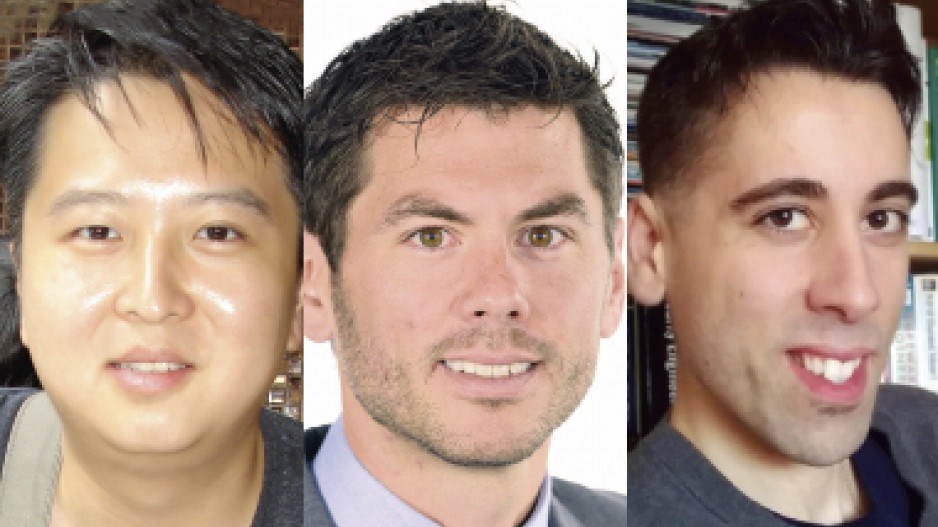

Mike Yeung - President, Simon Fraser Bitcoin Club

Accepting Bitcoin is free, shows customers that you are innovative and gives you access to those who prefer to spend bitcoins. If that sounds attractive, then retailers should offer Bitcoin as an extra option.

For physical checkouts, a retailer can set up an account with a payment processor such as BitPay and download the appropriate merchant app onto a mobile device. A web retailer would integrate the payment processor’s interface into its merchant website.

There is no monthly cost to maintain the infrastructure needed to accept bitcoins. When a customer pays in bitcoins, the electronic currency goes through the payment processor and the equivalent in Canadian dollars will be deposited into the retailer’s bank account – mitigating the risk of accepting bitcoins.

These days, the conversion and deposits are provided free of charge. Such cost savings can add up to a substantial amount should enough customers opt to pay in bitcoins. In turn, retailers can provide discounts or credits to Bitcoin users to retain their business.

Finally, Bitcoin is a “push-only” system much like cash. Unlike with credit cards, it is not possible for customers to initiate fraudulent chargebacks on purchases made in bitcoins.

Rob Cameron - Chief product and market officer, Moneris

Today the simple, straightforward answer is no; however, Bitcoin is certainly something that we’re keeping an eye on for our merchants. Bitcoin is an exciting technology, but it’s likely a little too early for the majority of Canadian merchants to jump aboard.

Most retailers that are accepting Bitcoin have done it for the media exposure as opposed to the actual business benefit – which is lacking right now. It is estimated that 2.5 million people own bitcoins globally; however, only about 1.2 million have a usable balance in their account. Among those who have sufficient balances, almost one million have less than a full bitcoin. For us, that’s too small a market to make a case for investing in the technology for our thousands of merchants.

One of the reasons for hesitation is that Bitcoin value has been volatile and it’s unclear when it will stabilize. As well, many governments, including regulators in Canada, see Bitcoin as a type of investment vehicle and the tax laws for Bitcoin are structured accordingly. What would happen if governments began to tighten regulation around Bitcoin or restrict its use? We’re seeing hints of increased regulatory pressure on Bitcoin around the world in places like Russia and China.

A key indicator that it’s still too early to accept Bitcoin is that the number of Bitcoin-accepting merchants has actually declined over the last year and a half. Most Bitcoin transactions are for currency speculation and exchange rather than retail purchase transactions.

While we’re excited about Bitcoin’s technology and we’ve evaluated how to implement it, it’s too early for Moneris to embrace it right now.

Michael Vogel - CEO and founder, Netcoins

I have excellent news: there are three great reasons to add Bitcoin to your business. These include the elimination of credit card fees, prevention of fraudulent transactions and an increase in spinoff sales from Bitcoin’s ideal customer demographic.

A few years ago you couldn’t buy anything with Bitcoin, but today it’s a truly disruptive technology that is great for mobile payments. Bitcoin is accepted by over 80,000 businesses, including multibillion-dollar companies like Microsoft, Dell and Expedia.

The elimination of credit card fees is an appealing prospect for most retailers.

Unlike debit and credit cards, which carry a constant risk of fraud, Bitcoin is a guaranteed and irreversible payment framework. This makes Bitcoin like cash for the Internet, and being able to remove fraud from the equation is incredibly valuable.

Bitcoin-friendly merchants also report as much as double-digit increases in spinoff sales. This is partly to do with the young, high-income and tech-savvy demographic that makes up much of Bitcoin’s user base. Retailers see Bitcoin as a way to attract this demographic, which is especially difficult in an age when most of this group shops exclusively online.

Worried about the price fluctuation of Bitcoin? Not a problem. When a customer pays with Bitcoin, most retailers convert immediately to fiat currency (i.e. dollars). In this manner, Bitcoin serves as a transaction medium as opposed to being held as a currency.

Stores can also earn additional revenue by selling Bitcoin, which is where my company, Netcoins, fits in.

With all these benefits, it seems that Bitcoin is very likely the payment processing mechanism of the future.