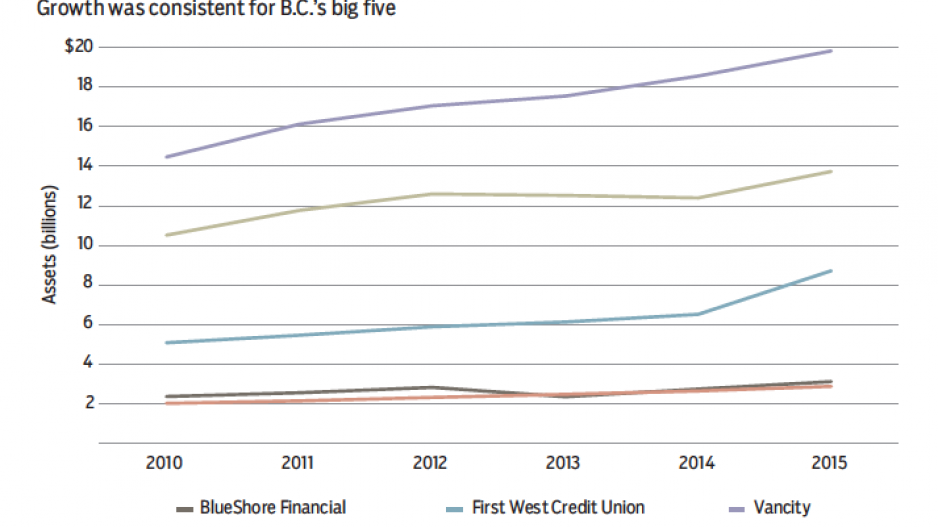

Asset growth was the theme for B.C.’s top credit unions during 2015.

First West Credit Union’s assets jumped 34% in 2015 compared with the 6% growth it posted in 2014. Coast Capital Savings recorded a 11% increase from 2014 to 2015 after its assets dropped 1% the previous year.

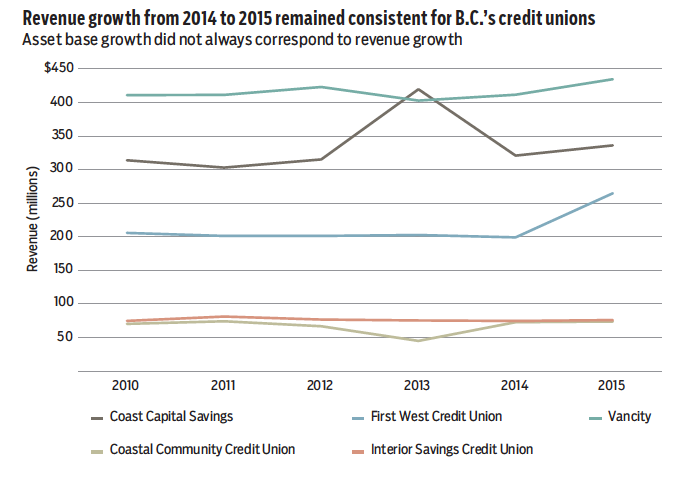

First West also posted the most significant revenue turnaround among the province’s top credit unions: up 33% in 2015 following a 2% decrease in 2014. Coast Capital Savings also posted a large revenue increase: up 4.7% in 2015 after suffering a 24% drop in 2014.

Revenue growth elsewhere among the top credit unions was far less dramatic.

Vancity’s grew 7% in 2015 compared with 2% in 2014. B.C.’s other top credit unions all posted revenue growth under 5%.

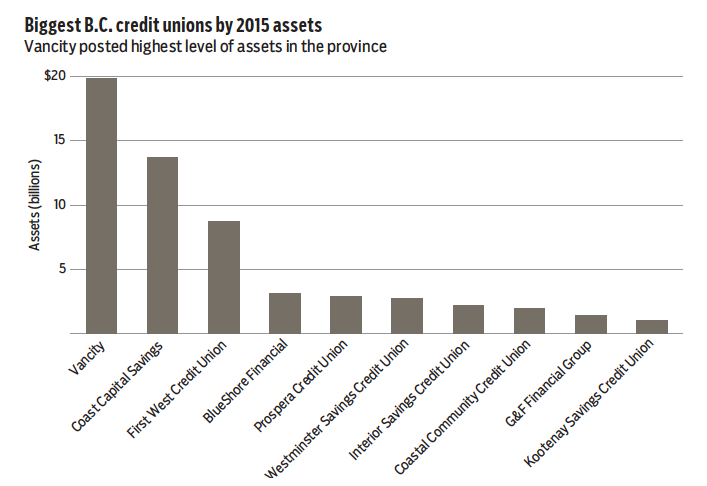

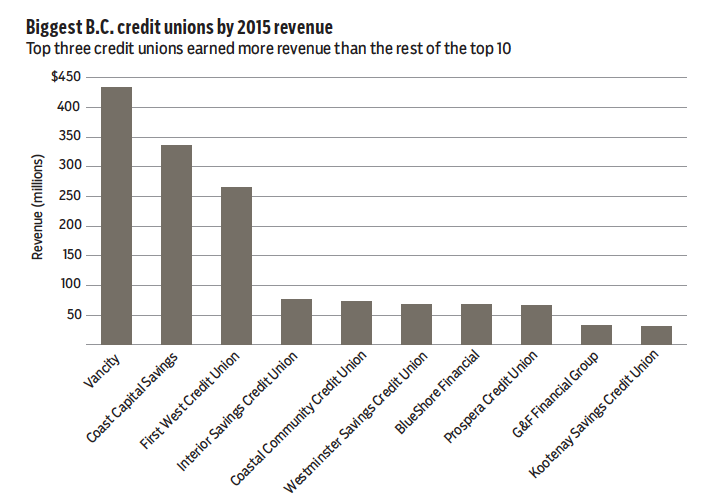

However, credit unions with high revenue did not necessarily have large asset holdings. BlueShore Financial and Prospera Credit Union had larger asset holdings than Interior Savings Credit Union and Coastal Community Credit Union. But Interior and Coastal traded off smaller assetholdings for higher revenue. BlueShore had the fourth-largest asset base but the seventh-largest revenue; Interior had the fourth-largest revenue and the seventh-largest asset base.

According to Kai Li, finance professor at the University of British Columbia’s Sauder School of Business, the discrepancy results from pricing.

Some credit unions can build larger asset pools by lowering their fees.

The lower fees might attract more deposits, but they lower the per-depositor revenue for credit unions.

Li added that credit unions that generate more sales likely have higher fees that allow them to generate higher revenue from a smaller deposit pool.•