Affordability challenges trump taxes when it comes to Metro Vancouver business concerns.

That’s among the key findings in a new Greater Vancouver Board of Trade (GVBOT) membership survey aimed at providing the organization with guidance for its advocacy strategy in the leadup to B.C.’s 2017 provincial election.

According to the survey, 42% of its members said that the collective taxes paid by B.C. businesses were too high compared with 37% who said they were not.

“We recognize as Canadians that not all taxes are bad,” said GVBOT president and CEO Iain Black. “We recognize as an organization that we need to provide governments with tax revenues to have the standard of living that we’ve come to enjoy in this country”

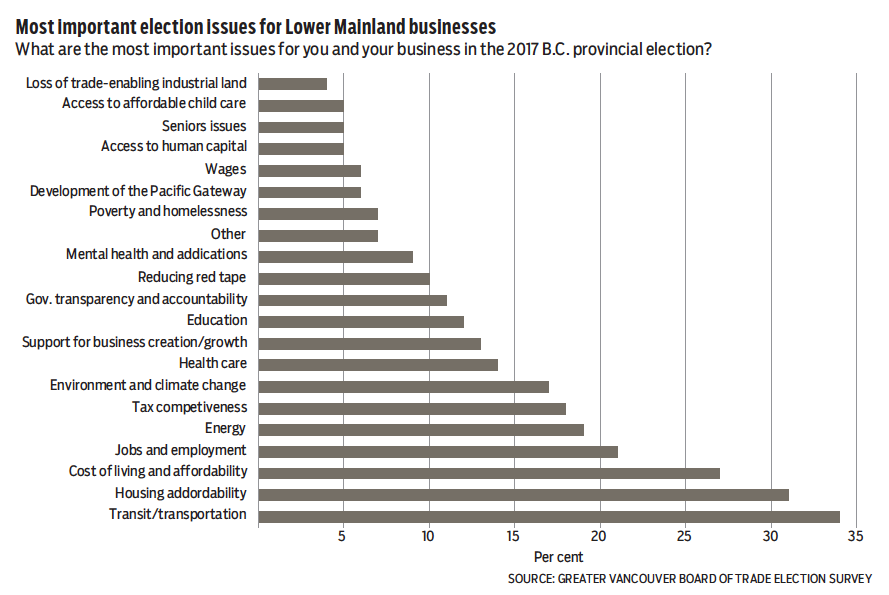

According to the GVBOT’s membership survey of business leaders, owners and managers, the overriding concerns of the region’s business community were primarily focused on the difficulties companies face in attracting and retaining talent.

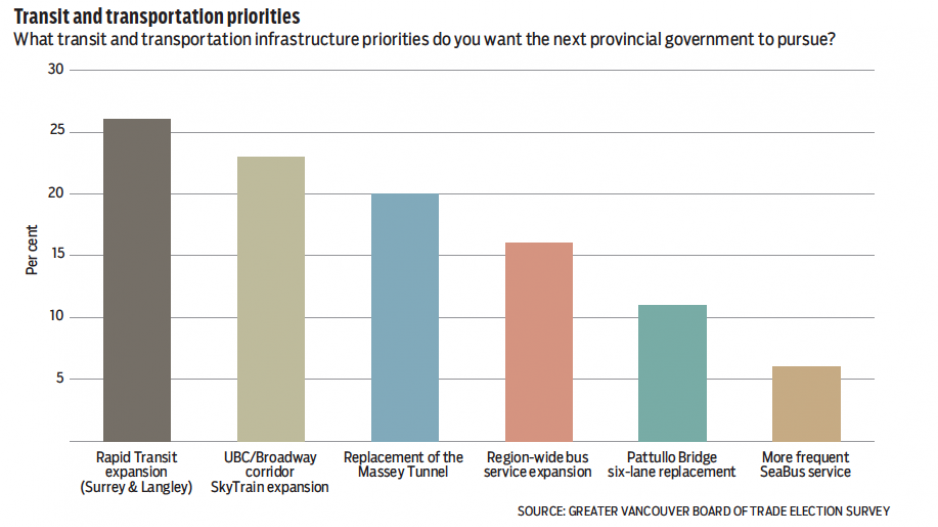

For example, Vancouver’s high housing prices deter people from moving to the region from more affordable places. Many businesses also highlighted a lack of investment in roads and transportation as a major concern.

According to Black, Greater Vancouver’s congested road system also increases the affordability of living outside of Vancouver and reduces the ability of businesses to attract talent.

While the majority of GVBOT members either didn’t think businesses paid too much in taxes or were unsure, the business community is concerned about how money, specifically at the regional level, is spent.

According to Black, municipalities sometimes have a difficult time looking past direct investments into their community and often don’t see how investments in their regional partners benefit them as well.

A similar sentiment was expressed in the election survey, as 69% of respondents said municipal, regional and provincial governments were not collaborating effectively to support economic growth in Greater Vancouver. Only 18% said the provincial government had an effective economic strategy for the Lower Mainland; 47% said the strategy was inadequate; 36% were unsure.

Along with transportation, businesses wanted more investment in trade-enabling infrastructure, port expansion and energy and resource development. Each received support of more than three-quarters of survey respondents. GVBOT members supported the addition of a foreign property transfer tax and mobility pricing to raise funds for infrastructure investment.

While many members said they didn’t think business taxes are too high, one in four respondents rated tax competitiveness as one of the most important issues. More than two-thirds of the survey’s respondents believe the provincial sales tax should be reformed.

“People can’t put their hand up and say, ‘I want the Massey tunnel replaced, I want to see expansion of the port, and I want to have all the infrastructure put around the pipelines to make sure it’s safe.’ We can’t say that and at the same time say I don’t want to pay the taxes to enable that to happen,’” said Black. “We believe in getting value for the tax dollars we pay, so the scrutiny we apply to the different levels of government is more about how is the money being spent, and does it translate to improvement of standard of living?”

Respondents also ranked jobs, energy and climate change as some of the most important issues facing B.C. businesses in the 2017 provincial election.

Energy development and climate ranked as top concerns for businesses, but 25% of respondents don’t support the Kinder Morgan Trans-Mountain pipeline expansion compared with 62% who supported it. However, the majority of respondents said the provincial government should pursue responsible development of British Columbia’s energy and natural resources.

Overall, Black was encouraged by the survey results. He said it shows that the local business community sides with saying yes to opportunity and new ideas rather than no. •