Average weekly earnings in B.C. fell in August, retracing all of July’s gain and moderating some of the positive momentum from recent months.

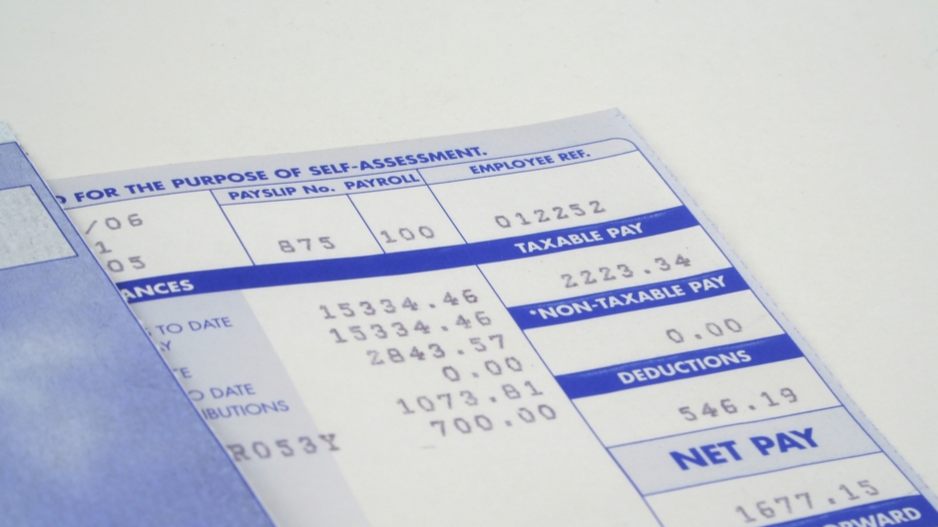

Weekly earnings for B.C. employees averaged a seasonally adjusted $904 – while up 0.4% from a year ago, earnings were down 1.1% from July. Nationally, average weekly earnings fell 0.7% but were up 0.8% from a year ago. B.C. weekly earnings remained below the national average of $947 and were fifth-highest among the provinces.

However, relatively lower earnings in large part reflect industry composition. Provinces with higher earnings are boosted by larger mining and energy sector employment.

Weekly average earnings are determined by a combination of industry wages, industry composition of employment and hours worked.

Year-over-year growth was tempered by a drop in average weekly earnings in the higher-paying goods-producing sectors (-2%). Average weekly earnings fell (-11.6%) in mining, oil and gas extraction and construction (-9.4%) and were flat in manufacturing, likely due to fewer hours worked during the month.

Service-producing sector wage earnings were up 1.1% from a year ago but were relatively lower at $861. Higher weekly wage earnings were recorded in the real estate, rental and leasing sector (4.2%), information and culture (3.2%) and transportation and warehousing (3.8%).

Despite the effects of employment mix, hours worked and industry composition, underlying wage rates in B.C. are still trending modestly above a year ago. The total number of paid employees in B.C. eased 0.2% from July, lowering the same-month growth to 0.9% in August from a year ago and pointing to some loss in mid-year momentum. Despite the dip, year-to-date employment was still moderately higher than a year ago by 1.6%.

Year-to-date growth is being driven mostly by the construction, professional, administration and support services, accommodations and food services sectors, while employment in the mining, quarrying and oil and gas extraction sectors has decreased.

This employment estimate from the Survey of Employment, Payrolls and Hours (SEPH) differs from the more often referenced and more timely Labour Force Survey (LFS), which is trending at a lower year-to-date pace of 0.7%. SEPH is a better measure of hiring momentum because it’s driven off a census of Canada Revenue Agency payroll deduction data and hence provides an accurate picture of firm hiring, but it does not include self-employed and farm workers. The LFS includes the latter two groups but is a household survey, subject to sampling variability. •

Bryan Yu is senior economist at Central 1 Credit Union.