B.C. credit unions comprise the biggest section of the market for the province’s small and medium-sized businesses, while elsewhere in Canada the Royal Bank is losing market share as business begin to shift to rival big banks and credit unions, according to a report from the Canadian Federation of Independent Businesses (CFIB).

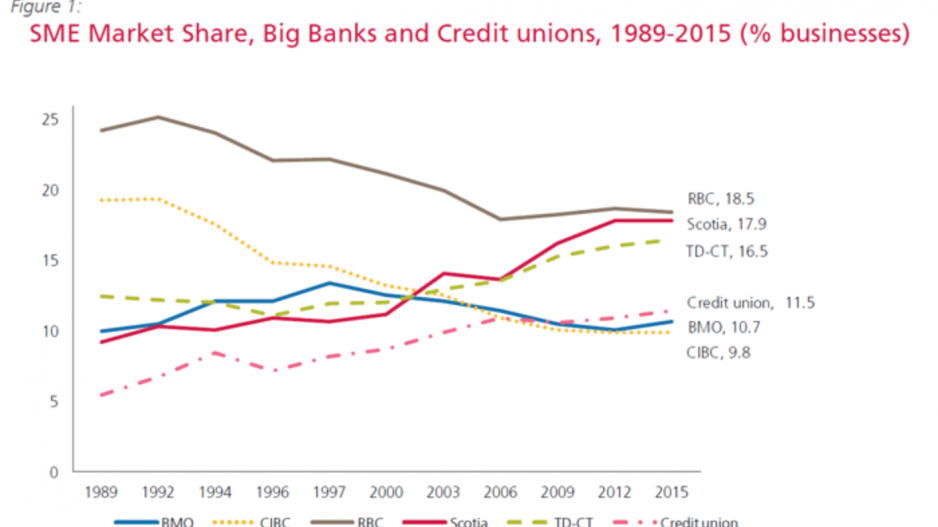

Countrywide, the report found, the Royal Bank has the largest share of small and medium-sized businesses at 18.5%, but lost 2.7% of its customers between 2000 and 2015.

The largest beneficiary of RBC’s market loss was Scotiabank, which jumped 6.7% to just under 18% of total market share. TD Canada Trust also benefited, increasing its market share by 2.8% to 11.5 %. CIBC had the least amount of market share, losing 3.5% from 2000 to 2015, dropping to 9.8% market share.

Aside from large national banks, regional banks were also well represented in the market share breakdown within their own provinces. Quebec-based Desjardins group, one of the largest associations of credit unions in North America, has 42.6% of the total small and medium-size enterprise market in that province. Alberta Treasury Branches hold the largest market share in Alberta with 19.7%

In British Columbia, credit unions have the largest market share of business from small and medium-sized enterprises at 23%.

Like B.C., Saskatchewan and Manitoba small and medium-sized business depend greatly on credit unions for their banking needs. Credit unions’ market share makes up 39.2% of the market within the two provinces.