B.C.'s unemployment slipped in August following two months of hefty gains but momentum remained positive.

Employment fell 0.3% to a seasonally adjusted 2.39 million persons as a drop in part-time was partly offset by a 1.2% increase in full-time counts. B.C.’s jobless rate eased to 5.5%, to mark a third straight monthly decline.

Like headline growth, employment changes from July in most industries were statistically insignificant – exceptions being gains in business, building and other support services (4.1%) and in information, culture and recreation (3.8%), and a 2.4% contraction in health care and social assistance.

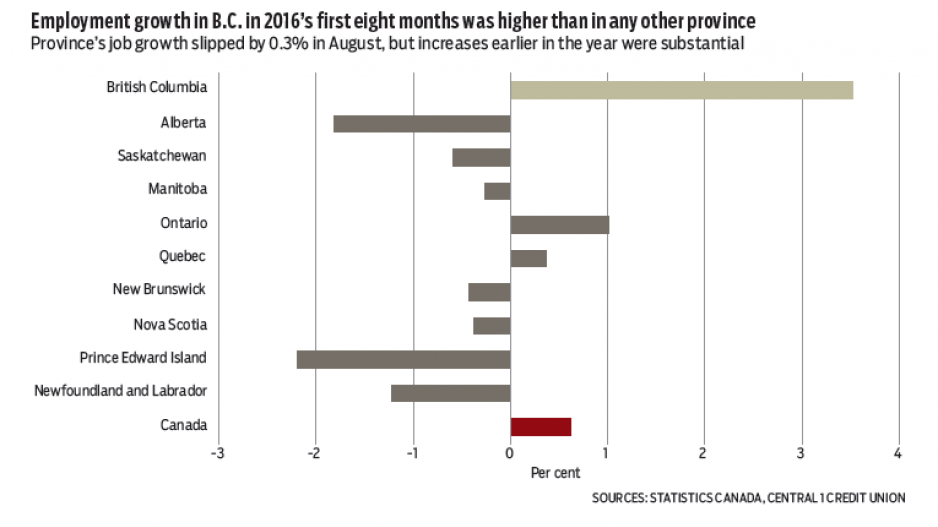

Even with the dip, B.C. remained far ahead of the national performance with a year-over-year gain of 3.1%. Comparatively, national employment, while up 0.1% from July, was anemic year-over-year at 0.5%. Year-to-date, B.C. employment growth averaged 3.5%, reflecting the province’s stronger economy and approaching the strongest gain since 1994.

Growth has been concentrated on the South Coast, underscoring a regional economic divide, with year-to-date employment growth of 6% in Metro Vancouver and more than 3.5% in Victoria. In contrast, employment gains have been weak in most other markets, reflecting commodity sector challenges.

August Multiple Listing Service data for the Lower Mainland provided a first look at the housing market following the 15% foreign buyers tax. Seasonally adjusted sales in the combined Metro Vancouver and Abbotsford-Mission real estate board areas (Lower Mainland) declined 17% from July, with unadjusted sales down 18% from a year ago.

While not entirely to blame, the foreign buyers tax undoubtedly helped fuel the drop. Sales have declined 40% from March, reflecting the abnormal strength in the market earlier in the year and disruption from the tax. In a normal sales downturn, a 25% peak-to-trough decline is not uncommon. Downward sales momentum is expected to last for a couple more months.

Despite the decline, sales-to-active listings ratios were still at a level normally consistent with a seller’s market in August, but down from accelerated conditions in the spring and trending toward balance. Declines reflected fewer sales, as active listings climbed a mild 7%.The average price fell to a seasonally adjusted $735,000, down 18% from July, and 23% from April’s peak, but reflected compositional shift away from single-detached sales, luxury homes and higher-priced areas. •

Bryan Yu is senior economist at Central 1 Credit Union