B.C. capped off a sparkling year for the provincial labour market with a strong finish. Employment jumped 0.7% from November to a seasonally adjusted 2.4 million persons in December, marking a 3.1% year-over-year gain to lead all provinces and outpace a monthly national gain of 0.3% and year-over-year growth of 1.2%.

Provincial unemployment fell to 5.8% of the labour force from 6.1% in November and 6.7% in the same month in 2015.

December’s strong performance signalled improved economic growth but was blighted by weaker growth composition. Full-time employment was virtually unchanged while part-time tenure surged 2.8%.

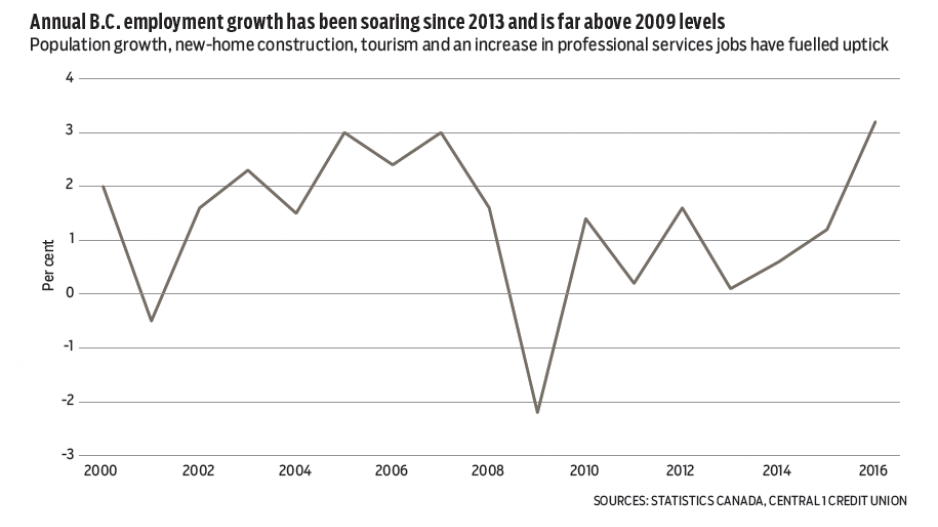

Nonetheless, 2016 proved robust for the labour market, as population growth, new-home construction, high levels of tourism and growth in high-value professional services lifted the economy. Average annual employment rose 3.2%, led by a 7.2% surge in part-time work and healthy full-time employment growth of 2.1%. Paid private-sector job growth led gains. The annual unemployment rate averaged 6% and was the lowest in the country.

Meanwhile, Lower Mainland housing market activity ended 2016 on a meek note. Following overheated spring conditions, Multiple Listing Service (MLS) sales slumped in the second half and prices eased, reflecting affordability constraints and restrictive government policies including higher taxes and more stringent mortgage insurance qualification criteria.

MLS sales, held range-bound since August (seasonally adjusted) in the Metro Vancouver/Abbotsford area region, were weak through December, falling 39% from the same month in 2015.

Despite the downturn, annual sales edged higher by 1.2% from 2015 to reach a record 63,966 sales owing to strong activity early in the year. Sales growth in the valley offset a decline in markets north of the Fraser, which could reflect more foreign purchasing in areas like Richmond and Burnaby, and more affordable homes in eastward markets.

Price declines have followed weaker sales and consumer confidence. The constant-quality MLS benchmark value fell 1% from November to $803,900 and about 3% from the August peak, but remained 20% higher year-over-year.

While demand has faltered, new listings and inventory remain low as most homeowners are under little pressure to sell given a healthy labour market.

2017 sales are forecast to decline about 15% while peak-to-trough benchmark price declines are forecast at about 5%, marking a correction but not a crash as inventories stay low.

Bryan Yu is senior economist at Central 1 Credit Union.