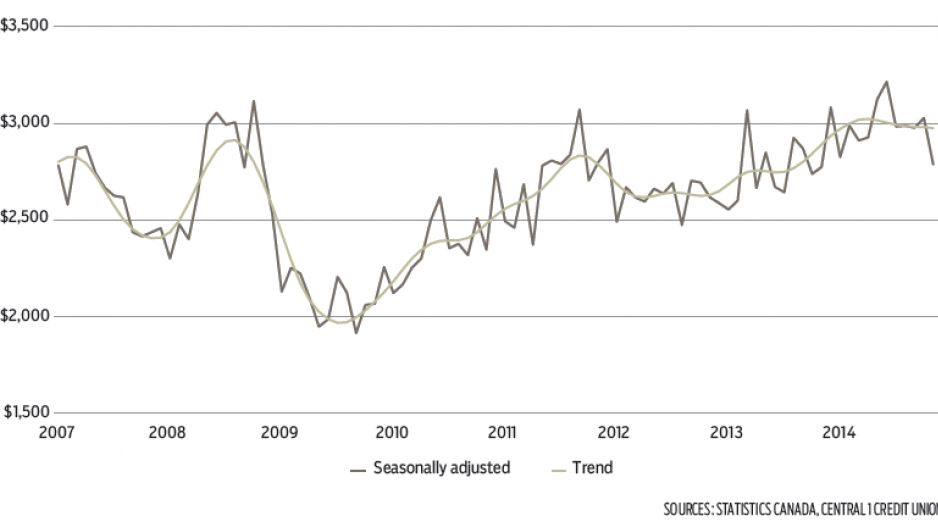

B.C. export sales took a hit in November as dollar-volume sales to international markets fell about 8% from October to a seasonally adjusted $2.79 billion. This was the weakest monthly performance since November 2013. Declines were observed broadly but concentrated in energy and metal and mineral products.

In particular, exports of energy products fell 16% or $100 million, while metal and non-metallic mineral products exports declined by 25% or $62 million from October. The former was driven by lower physical coal shipments to China and Japan, which were part of a 30% drop in overall coal exports, while dollar-volume shipments of natural gas held steady. Lower gold shipments contributed to the latter.

It is advisable not to read too much into November’s export performance, given that declines were in product markets that often show significant export fluctuations, while the general trend heading into the month was steady. Even with the pullback, dollar-volume exports through 11 months were nearly 8% above the same period in 2013, with physical shipments representing about 3% of the gain. Through November, growth was led by metals and non-metallic minerals – which were 19% higher despite lower prices – forestry, agriculture and manufactured goods segments.

We expect exports to remain a growth driver for the economy. Although coal and metals exports could dampen as a result of recent and pending mine closures/suspensions (a product of low demand/prices and environmental accidents), stronger growth in the U.S. economy and a lower Canadian dollar should provide a lift. In particular, forestry and broader manufacturing are expected to expand in 2015. Lower oil prices will continue to pull the Canadian dollar down, while also lowering import and transport costs for businesses.

Broader real export growth, which includes shipments of goods and services to international and other provincial markets, is expected to accelerate to 3.3% in 2015. Exports will outpace import growth, which will be dampened by the lower exchange rate. •

Bryan Yu is senior economist at Central 1 Credit Union.