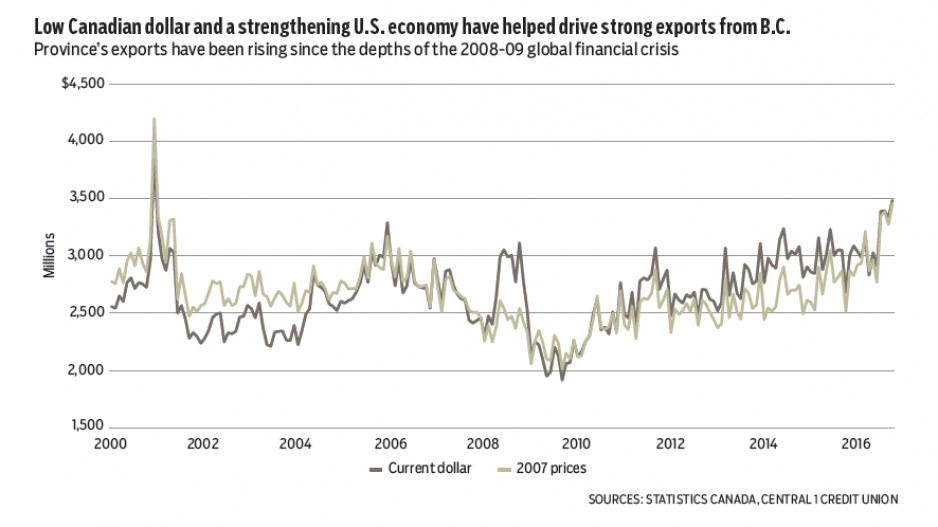

B.C. trade-oriented growth continued to shine in October with surging international goods exports. Dollar-volume exports jumped close to 29% year-over-year in October. While partly reflecting a base-year effect, momentum remains strong. Dollar-volume shipments climbed more than 4% from September to $3.48 billion. Rising export momentum lifted monthly international export volumes to their highest levels since the early 2000s. Year-to-date growth in export volume rose to 6% with estimated real price-adjusted gains closer to 10%. Year-to-date imports were down 1.1% through October. This resulted in narrowing of B.C.’s international trade deficit, with the real price-adjusted position in surplus.

Strong exports have been driven by a low Canadian dollar and strengthening U.S. economy. Higher U.S. housing starts and a one-year grace period following the end of the softwood lumber agreement in 2015 have boosted forestry-sector activity. Imports have declined in part because of higher prices due to the exchange rate.

Fundamentals support export growth in 2017, but the end of the softwood lumber agreement grace period and the probability of punitive tariffs will likely impede shipments.

November housing activity in the Lower Mainland was restrained by recent policy measures and weaker confidence. Multiple Listing Service sales were steady but edged lower from October, marking a stabilization after a spring sales plunge. Nonetheless, sales were down 35% year-over-year and were the lowest since 2013, with population-adjusted sales about 20% below post-2000 norms.

Despite signs that the direct effects of the foreign-buyer tax may be dissipating, tighter mortgage insurance criteria for low-equity buyers, particularly through higher qualifying rates, likely dampened sales.

Nonetheless, flow of weaker demand to prices has largely been muted by low inventories. The downturn in sales has generated a decline in new listings as sellers move to the sidelines, while active listings are up but level from last year. At 26% the sales-to-active-listing ratio is still aligned with a balanced/mild seller’s market. While market conditions are weakening, there are few signs of panic selling due to a healthy labour market, except for some speculators who purchased in the spring.

Housing will remain in a low-sales state with mild erosion in prices. Tighter mortgage insurance rules will continue to have a material impact on sales volume and drive the multi-family market into a more balanced state. The peak-to-trough benchmark price decline is forecast at about 5% to 7%. •

Bryan Yu is senior economist at Central 1 Credit Union.