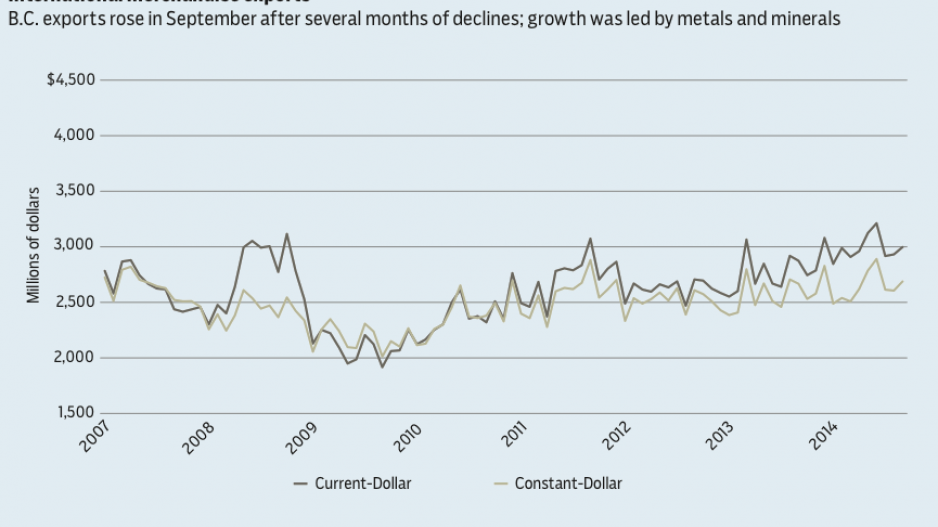

British Columbia merchandise exports to international markets turned around in September following a two-month lull as mining output and manufactured products lifted overall activity. Total dollar-volume exports climbed 2.2% from August to just under $3 billion (seasonally adjusted) of merchandise. Although still below mid-year highs, volume was nearly 5% above the same month in 2013.

Recent trends point to a clear rotation to trade-led growth in B.C.

Merchandise exports have tracked moderately higher this year and through the first three quarters were up 8.1%, with about 3% representing real shipment gains with relatively broad-based growth.

Growth has been led by metals and minerals, which despite a low-price environment are up 27% from a year ago, as past mining investments have led to higher production. Forestry exports are up about 7% owing in part to stronger pulp and paper, while agriculture, machinery and parts manufacturing have climbed significantly.

A favourable Canadian dollar and strengthening demand from the United States have broadly lifted demand. Energy sales have underperformed with year-to-date growth of 2%, but this masks a stronger performance by natural gas that has offset weakness in the coal sector.

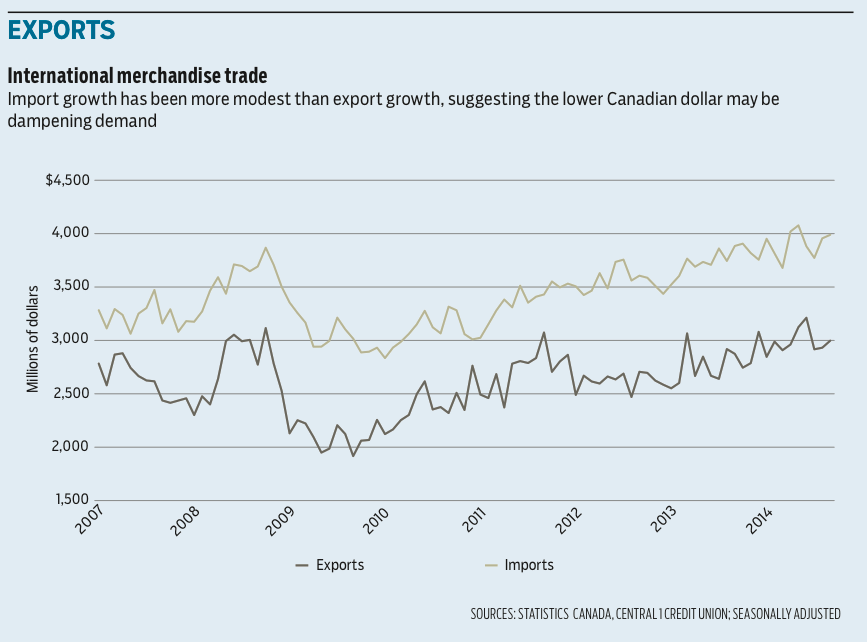

In contrast, imports growth has been more modest. Dollar volume was up 4.7% year-to-date, with most of the gain representing higher import pricing.

Real imports were flat relative to a year ago, suggesting the lower Canadian dollar may be dampening demand for foreign inputs or consumer goods.

Trade-sector momentum is expected to persist into and through 2015 as exporters gear off stronger demand from the U.S. and softness in the Canadian dollar.

Broader real export growth, which includes shipments of both goods and services to other provinces and international destinations, is forecast to reach 3% this year.

Bryan Yu is an economist at Central 1 Credit Union.