B.C. manufacturing rebounded in December, suggesting an end to the softer range-bound pattern seen since April.

Factory shipments reached a seasonally adjusted $3.62 billion during the month on higher wood products and machinery manufacturing gains, up 0.7% from November. However, this fell short of national growth of 1.2% during the month, with shipments 3.2% below the same month in 2014.

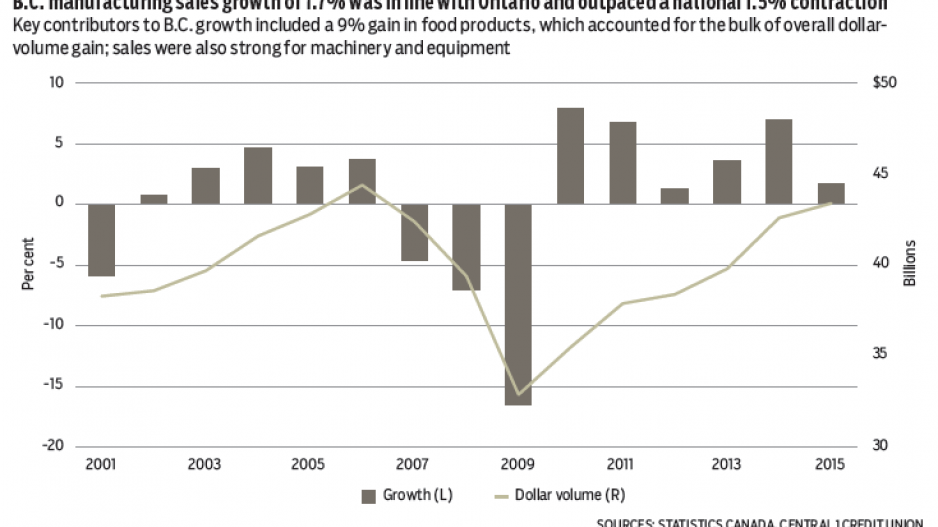

Despite recent momentum loss, B.C. manufacturing still outpaced most other provinces in 2015. Growth of 1.7% was in line with Ontario and outpaced a national contraction of 1.5%. Weakness in oil-producing provinces (-12.9%) was the key drag on the national performance. For B.C., a tepid Canadian economy and softer growth in the U.S. and broader economy likely dampened demand, which, combined with excess global supplies of some key wood products, offset the lift from a low Canadian dollar.

Key contributors to B.C. growth included a 9% gain in food products, which accounted for the bulk of overall dollar-volume gain. Machinery and furniture, computers and equipment also posted significant growth. Wood products manufacturing climbed by a mild 1.4%, owing to competitive global conditions.

Annual sales were the highest since 2006 at $43.4 billion – a sixth straight increase – but below inflation-adjusted cycle highs during the early to mid-2000s. Manufacturing is expected to revisit a positive trend as the low Canadian dollar and improved U.S. economic growth and housing market underpin demand for B.C. exports.

Meanwhile, December retail sales, seasonally adjusted, declined 1.4% from November on weaker auto-related sales. In actual terms, B.C. sales jumped 14.5% over November during the Christmas buying season.

Retail sales closed out 2015 with a strong 6.8% gain, supporting the view that B.C.’s economy is growing at a substantial pace as it relates to consumer spending. The growth performance was the best since 2007. After adjusting for price inflation, real retail sales are estimated to have risen 6.4%, the fastest pace since 2006.

Metro Vancouver continued to lead the province in consumer spending. Retail sales surged 10.1% to $34.1 billion during 2015. This was the best performance on record and reflects Vancouver’s higher employment and population growth compared with the rest of B.C., and, of course, more robust housing activity. •

Bryan Yu is senior economist at Central 1 Credit Union.