Against the backdrop of a choppy and risk-prone global economy and slowing growth in Canada, B.C. is poised to be atop the provincial growth rankings this year.

The international economic picture has deteriorated since late 2014. Notably, the first part of this year yielded disappointing results for the United States and China. Weaker growth across many of the emerging markets is also weighing on the global outlook.

With commodity prices low and oil-driven recessions unfolding in Alberta and Newfoundland, the prospects for Canada’s economy have dimmed. At the outset of this year most pundits saw Canada growing by 2% or more in 2015, but now expectations are in the 1% to 1.5% range. The Bank of Canada is calling for the national economy to expand by a tepid 1.1% in 2015 before picking up somewhat next year.

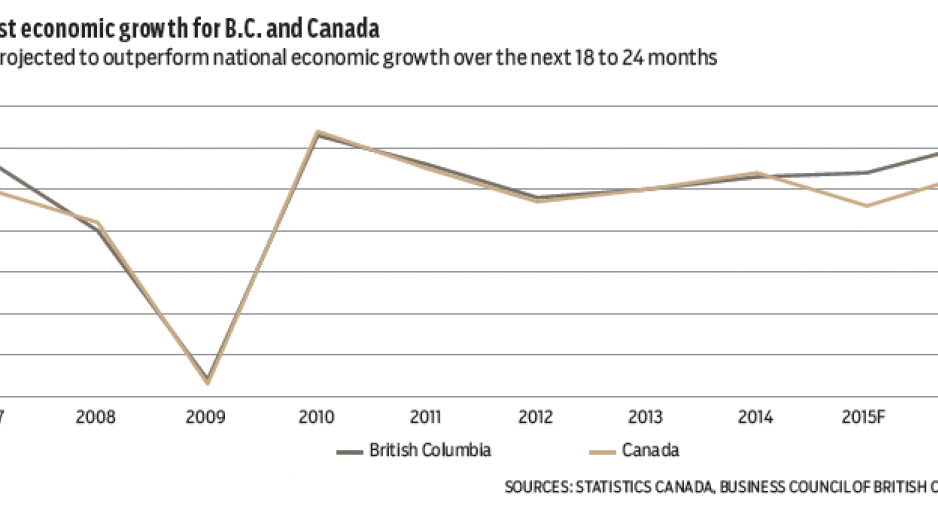

As a small trade-oriented jurisdiction, B.C. is not impervious to these economic headwinds. The gloomier external setting has prompted us to trim our growth outlook for the province to 2.4% this year, down from January’s 2.6% forecast. However, in the Canadian context B.C. is likely to post a decent economic performance over the next 18 to 24 months.

The export picture is mixed. Dismal natural gas markets and low prices for coal and many metals are dampening the province’s overall export numbers. However, there have been gains in some of our export-oriented industries, including non-resource manufacturing, wood products and agricultural goods, all of which are benefiting from the lower Canadian dollar and a healing U.S. economy.

It is sometimes forgotten that services have become a substantial part of B.C.’s export base. Here, the gateway sector – the province’s ports and the related rail, trucking and other logistics industries as well as Vancouver International Airport – will help to lift growth, along with tourism and an array of professional, business, technical and other high-end services. Tourism stands out as a bright spot for British Columbia. U.S. residents venturing north are now benefiting from a 20%-plus currency-driven discount and are coming to B.C. in growing numbers.

On the domestic side of the B.C. economy, the story is mainly positive, notwithstanding worries about consumer debt levels, somewhat sluggish job growth and Lower Mainland housing affordability issues.

The number of people working in B.C. has increased modestly over 2015’s first half.

One of the strongest economic indicators for B.C. is consumer spending. The momentum in retail spending is projected to continue, aided by low interest rates, an uptick in population growth and further declines in cross-border shopping.

The B.C. housing market has strengthened in recent quarters and looks set for further gains as mortgage rates plumb new depths and demographic growth helps to underpin housing demand. Thanks to brisk sales, new home construction has risen, which is contributing to B.C.’s economic growth rate.

Looking beyond 2015, we see the B.C. economy picking up with real GDP increasing by just over 3% in 2016. This hinges on one large liquefied natural gas project starting by mid-2016, along with some improvement in other segments of non-residential construction.

In summary, the Business Council of BC believes that B.C. will experience roughly the same rate of economic growth this year as in 2014. Considering the challenging external environment, this counts as a respectable showing. By 2016, the province can look forward to stronger growth as a handful of major investment projects move ahead. That British Columbia can still achieve reasonable GDP gains in the midst of a “slow-growth” world and generally low commodity prices testifies to our economy’s underlying resilience. •

Jock Finlayson is the Business Council of British Columbia’s executive vice-president and chief policy officer; Ken Peacock is the council’s chief economist and vice-president.