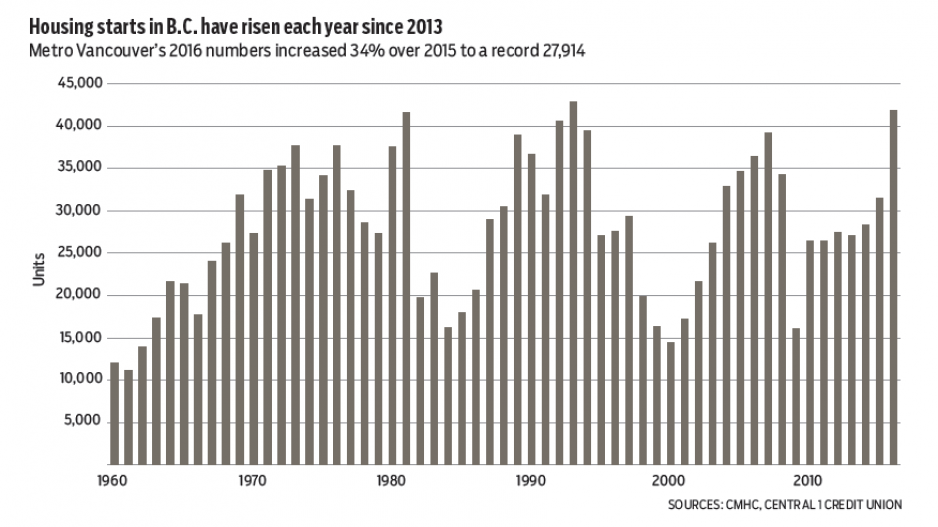

B.C. housing starts eased in December after a November surge but provided a strong handoff to 2017 while adding to a near-record annual performance.

Urban-area housing starts reached a seasonally adjusted annualized rate of 39,100 units, down 10% from November’s 43,500, but 16% higher than the same month in 2015. Fewer multi-family starts in the Vancouver census metropolitan area (CMA) offset gains in other urban areas.

While monthly starts are volatile given the infrequency and indivisibility of multi-family construction, the trend has remained elevated, with a positive but decelerated growth in the Vancouver CMA and a rising trend in other urban areas. Despite a resale market slowdown, strong pre-sale activity of projects on the books and relatively low housing inventories across the province have underpinned new construction activity.

Urban provincial starts were the highest on record at 39,498 in 2016, a 32% increase from 2015. Vancouver CMA starts climbed 34% from 2015 to 27,914 units, which smashed the previous record of 21,834 units observed in 1989. Including rural areas, starts totalled 41,840 units, slightly below the record high recorded in 1993. Housing starts are forecast to decline 10% in 2017 due to tighter mortgage insurance requirements and high numbers of units under construction in the Vancouver CMA.

Export momentum continued in November as shipments abroad jumped for a second straight month. Total dollar volume of goods exports climbed 26% from the same month in 2015, with a 9% increase from October to a seasonally adjusted $3.76 billion. This marked the highest one-month performance since late 2000, extending an upward pattern since mid-year. Recent gains have piggybacked on a revival of energy product export trends.

Year-to-date dollar-volume exports rose 8%, but price-level adjustment suggests real shipment growth of above 10% and a solid lift for the economy in 2016.

A rebound in energy exports (16%), which likely reflects higher coal prices as well as steady natural gas exports and sharp gains in processed metals and minerals (33%) and forestry (8.2%), underpinned year-to-date gains. About 55% of B.C. international goods exports are shipped to the U.S., with the three markets comprising about 80%. Among smaller export partners, exports climbed significantly to South Korea (8.9%) and India (12.4%) but declined to Germany (-6.7% ) and Mexico (-51%). •

Bryan Yu is senior economist at Central 1 Credit Union.