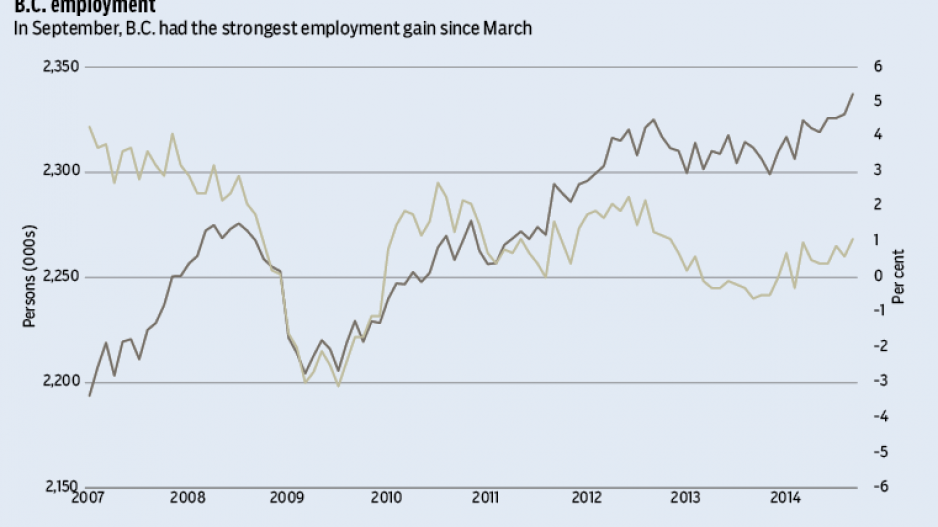

British Columbia’s labour market matched national employment growth in September, pointing to some spark in what has been a hapless labour market. Total employment climbed 0.4% from August to a seasonally adjusted 2.34 million persons to mark the strongest month-to-month gain since March. Further adding to the rosier picture was the surge in full-time employment of 1.1%, which more than offset a downshift in part-time employment and suggested a pickup in job quality during the month. Unemployment held steady at 6.1% of the labour force.

Among industries, there remained significant variation. However, growth was generally concentrated in the service sectors, with the strongest gain in finance/insurance/real estate, which gained 7%. In contrast, employment in education services fell 7.7% from August as the teachers’ strike that extended into late September contributed to the decline. Meanwhile, the provincial goods sector posted net job losses in September.

September’s employment performance was welcome news on the labour front and added to gains in recent months, suggesting mildly positive momentum. That said, fluctuations are the norm with labour data and a reversal would not be a surprise. This is particularly the case given that the volatile youth segment (age 15 to 24) accounted for all of September’s gain. In contrast, the group above the age of 25 shed workers during the month.

B.C.’s labour market is showing signs of gradual improvement, but remains soft even with September’s bounce. While employment was up 1.1% from the same month in 2013, this partly reflected a downshift last year, and average year-to-date growth sat at a disappointing 0.6% through three quarters. The employment rate, which measures employed people relative to the working-age population, remains below 60% and is down about half a percentage point from a year ago and down from 63% in 2007-08.

Soft employment growth is forecast to continue, but we expect more employers to creep back into hiring mode. Broader economic growth is driving a pickup in exports, while small business confidence remains strong, which should drive hiring. Annual employment growth is now forecast to reach about 0.8%. That said, the slow hiring pace is also a hindrance to, as much as a reflection of, economic growth, as persistent labour market slack dampens wage and income growth and spending.

Bryan Yu is an economist at Central 1 Credit Union.