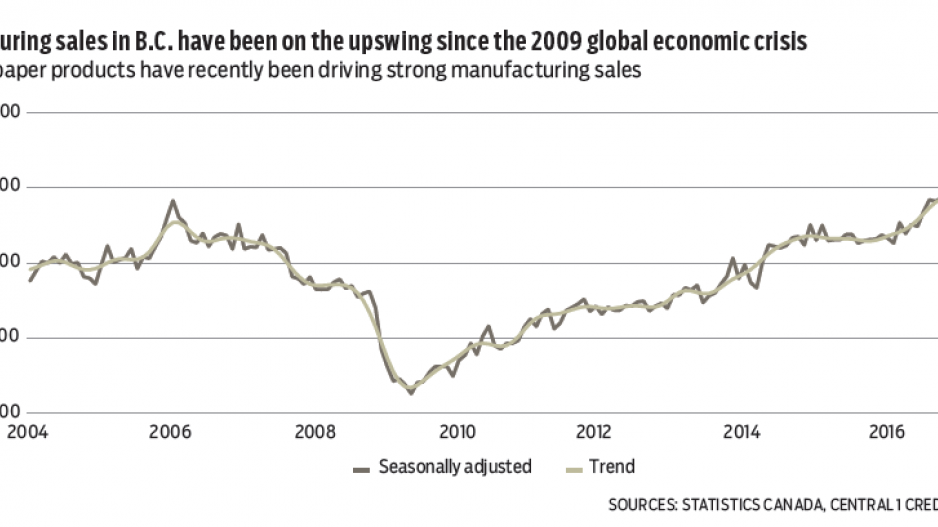

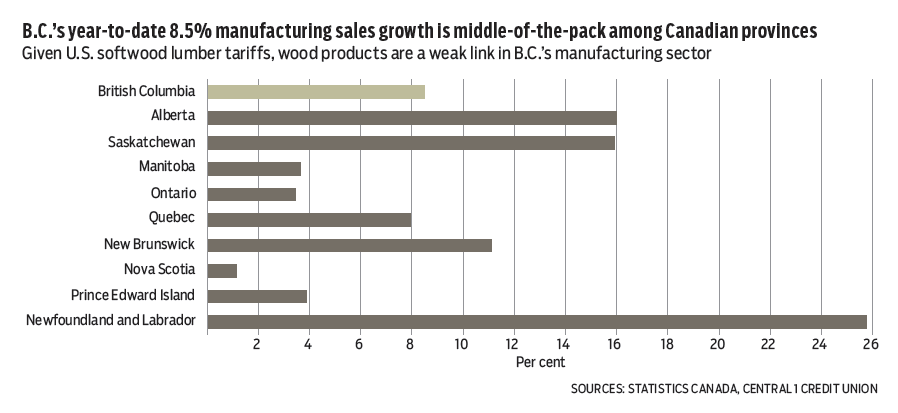

Bucking declines in nearly all other provinces in June, B.C.’s manufacturing sector added to recent momentum with a fourth consecutive monthly sales gain. Total sales rose 0.9% from May to a seasonally adjusted $4.19 billion, compared with a 1.8% drop nationwide, to push year-to-date sales growth to a healthy 8.5%.

Production of non-durable goods contributed to the bulk of the monthly gain, with food products and paper as key drivers. In the durable-goods sector, solid increases in sales of machinery, electrical equipment, primary metals and non-metallic mineral products were offset by lower sales of wood products and transportation equipment.

B.C.’s rising manufacturing growth trend is being underpinned by a competitive Canadian dollar through export demand and capacity growth in sectors like primary metals. If there is a weaker link, it is forestry. While year-to-date sale are positive, this largely reflects higher prices, as the ongoing softwood lumber dispute and associated tariffs have eroded real production, with wildfires likely to cut output even further.

On the housing front, B.C. Multiple Listing Service home sales slowed for a third straight month in July but remained high while a seller’s market continued to lift prices.

Sales fell 1.9% from June to a seasonally adjusted 8,503 units, driven by the Lower Mainland-Southwest markets, Victoria and northern B.C., with the Kelowna-anchored region providing some offset. Declines in northern markets (-18.8%) likely reflected the effect of wildfires in the Cariboo region.

Despite the decline and a 6% drop from a year ago, home sales were well above a typical July pace. Elevated housing demand is owed to a strong economy, low interest rates and population growth, while the B.C. down-payment program has also contributed. A year-to-date decline of 17% largely reflects a record-high pace in early 2016. Strong sales are evident across the province.

Despite a lift in listings, sales-to-active-listings point to seller’s markets in nearly all regions outside the Kootenay and northern B.C., with the tightest markets persisting on Vancouver Island and the Fraser Valley areas, signalling further upward price momentum.

The average provincial price was unchanged from June at $718,500, but the trend is positive and back to peak 2016 levels. That said, price gyration in the past year has largely reflected sales composition rather than price movements.

Average price trends remain positive in most other board areas, with year-over-year gains of more than 10% on the Island and 5% to 10% in the southern Interior. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.