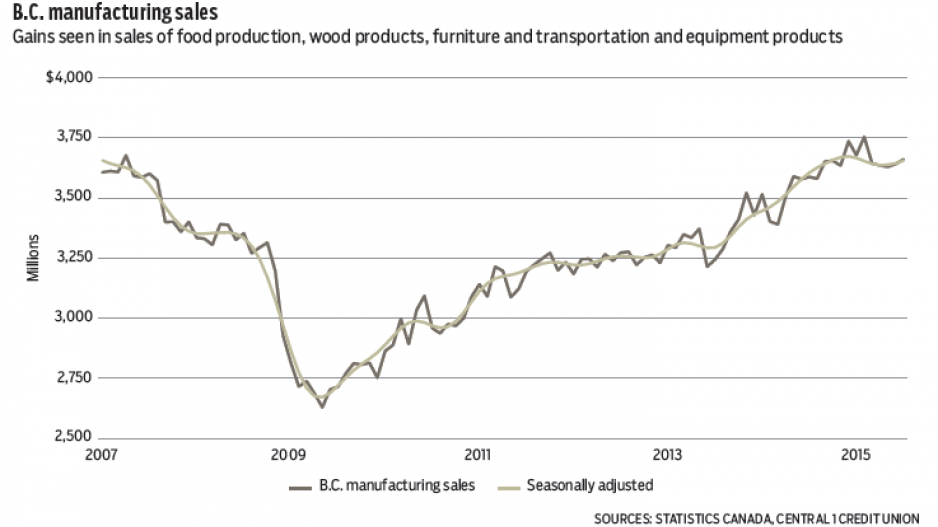

Factory sales for B.C.’s manufacturing sector rose in July, a second straight monthly gain that points to improved business conditions and increased export demand. Month-over-month factory shipments accelerated 0.5%, pushing sales to an estimated $3.66 billion – the highest level since February.

While provincial sales growth lagged behind the national gain of 1.7%, B.C. has still outperformed relative to a year ago. Year-over-year same-month growth of 2% in August compared with declines in nearly all other provinces.

Year-to-date dollar-volume shipments were 4.5% higher, while national sales declined 2%.

Among product markets, non-durable goods manufacturing is leading gains, driven by a 17% rise in food production, particularly in seafood, which is accounting for more than half of dollar-volume growth.

B.C. manufacturers will continue to post growth in sales. U.S. economic growth is forecast to average about 2.8% in 2016 and 2017, marking acceleration from 2.4% this year, while the Canadian dollar further weakens against the greenback to about US$0.73 over the next two years.

These will be the key drivers of rising export demand and underpin a rise in real manufacturing output of 4% this year and 3% in 2016.

Headline consumer price inflation remained well contained in August but moved higher for a second consecutive month with year-over-year growth in B.C.’s consumer prices climbing to just below 1.2%.

B.C.’s mild inflationary increase has been driven by rising prices this year, with the monthly consumer price index climbing in six of the past seven months (seasonally adjusted).

However, growth has softened to an annualized 1.8% (seasonally adjusted) over the past two months, compared to a near 3% trend earlier in the year.

Despite recent gains, B.C. remains in a low-inflation environment. Among major components, energy prices are still significantly lower than a year ago and are a drag on general price levels.

Gasoline prices were down 7.2% from a year ago, while natural gas prices were down a steep 18%.

In contrast, upward pressure is being led by a 3.6% increase in food prices, led by an 11.5% increase in vegetables and 7.2% gain in meat prices. Women’s clothing prices also jumped from a year ago by 3.4%, while recreation, reading and education segment pricing rose 3.9%. Above-average price growth was also recorded for Internet services (12.7%) and homeowner insurance (5.8%). •

Bryan Yu is senior economist at Central 1 Credit Union.