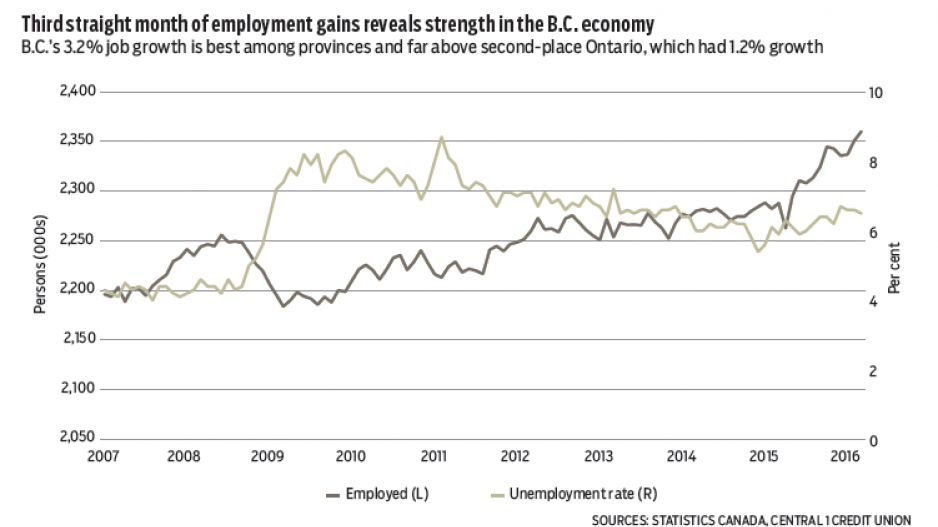

B.C.'s labour market remained in fine form in March, with a third straight monthly employment gain signalling further improvement in the economy.

Employment reached 2.36 million persons, up 0.4% from February, adding to the rising trend observed since mid-2015.

Year-over-year employment growth of 3.2% (72,100 persons) is head and shoulders above all other provinces, with the closest performer being Ontario at 1.2%.

Professional services (2.2%), agriculture (29.1%), utilities (5.2%) and transportation/warehousing (5.9%) led monthly gains.

The unemployment rate eased to 6.5% from 6.6% in February. While up 0.6 percentage points from one year ago, this does not reflect a weak hiring environment, given the robust employment gains, but rather highlights labour force growth. Rising population and a higher participation rate have swelled the labour force.

Unadjusted for seasonal factors, year-over-year employment growth was trending strongest in the metropolitan regions of Vancouver (5%) and Victoria (4.1%), as other regions and urban areas showed employment losses and higher unemployment rates.

We are out of superlatives to describe the incredible strength of the Lower Mainland housing market. Sales tracked higher in March in the combined Metro Vancouver and Abbotsford-Mission areas with a 40% year-over-year gain. Seasonally adjusted monthly sales increased 3% from February to 7,050 units – a quarter above previous cyclical highs.

The longevity and strength of this demand cycle continue to surprise. A strong local economy, low mortgage rates and international demand are factors, but rising prices may be fuelling panic buying in the market as the fear of being priced out increases.

The representative benchmark price index for the region climbed 23% from a year ago to $719,500.

The seasonally adjusted benchmark climbed 2% from February, to extend an unbroken upward price trend since June 2013. While led by a 27% year-over-year growth in sales of single-detached homes, price momentum is now robust among multi-family properties, at about 18%.

This price up cycle is forecast to continue through at least the end of the year, underpinned by a severe shortage of inventory and strong demand fundamentals.

The current sales trend is anticipated to moderate by mid-year. •

Bryan Yu is senior economist at Central 1 Credit Union.