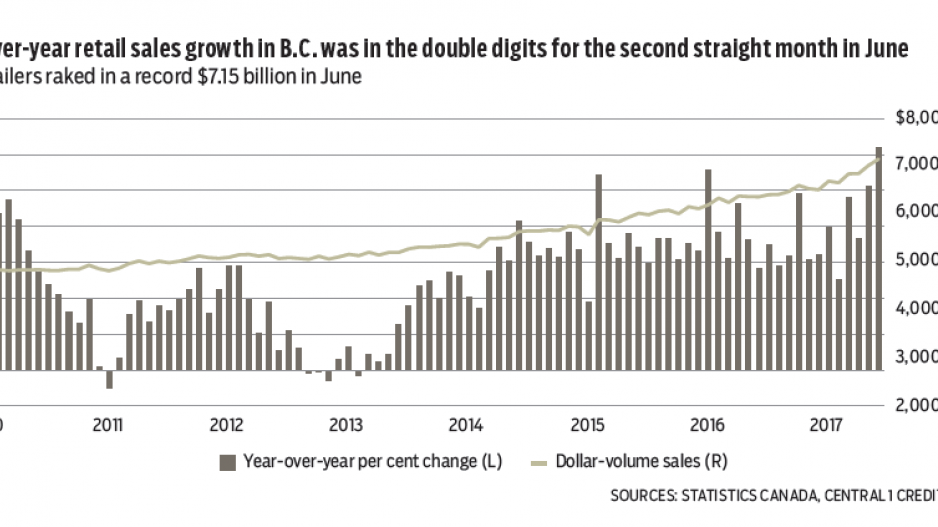

B.C. retailers posted another blowout month in June, with sales rising for a fourth consecutive month. Sales surged 1.9% to a record $7.15 billion in June, compared with a countrywide increase of 0.1%. Year-over-year growth accelerated to 12.4% from 10% in May, lifting first-half sales growth to 9%. Excluding B.C., growth in the rest of Canada was a more modest 6.6% over the first six months.

Strong employment growth, population growth, active housing markets and a tsunami of tourists have underpinned the stellar retail performance. While spending on big-ticket items such as vehicles and building material drove gains, most retail segments posted strong sales increases.

Inclusion of big-ticket items such as vehicles sales, and gasoline sales, which are influenced by pump prices, can mask underlying consumer demand trends. Nonetheless, exclusion of these sectors shows a year-over-year gain of 10%, and a year-to-date increase of 6%, pointing to high levels of consumer demand.

Retail sales in Metro Vancouver rose 3.5% from May to lift first-half growth in the region to 8.4%, but remained lower than the rest of the province at 9.5%. With tame inflationary pressures, nearly all this year’s increase reflects a rise in purchasing activity.

The growth trends are expected to decelerate in the last half of the year, easing annual growth to 6.1% from more than 7% in 2016.

Adding to this freewheeling spending theme in June were restaurant and bar sales, which jumped 1.9% to $945.6 million – the fourth straight monthly increase. Rising momentum pushed total sales higher by 6.5% through the first half of 2017, compared with a national increase of 4.7%. Second to B.C. in growth was Manitoba at 5.8%.

As with the retail industry, the hospitality sector has likely been helped by labour market strength and rising tourism in the province, not to mention a thriving food culture. Sales at full-service restaurants (5.7%) and quick-bite eateries (10%) have boomed through the first half. For the latter, the rise of cheap chic and hipster canteens and the popularity of food trucks may be taking market share. Annual sales growth will fall short of last year’s 10% gain, but will be in line with growth from both 2014 and 2015. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.