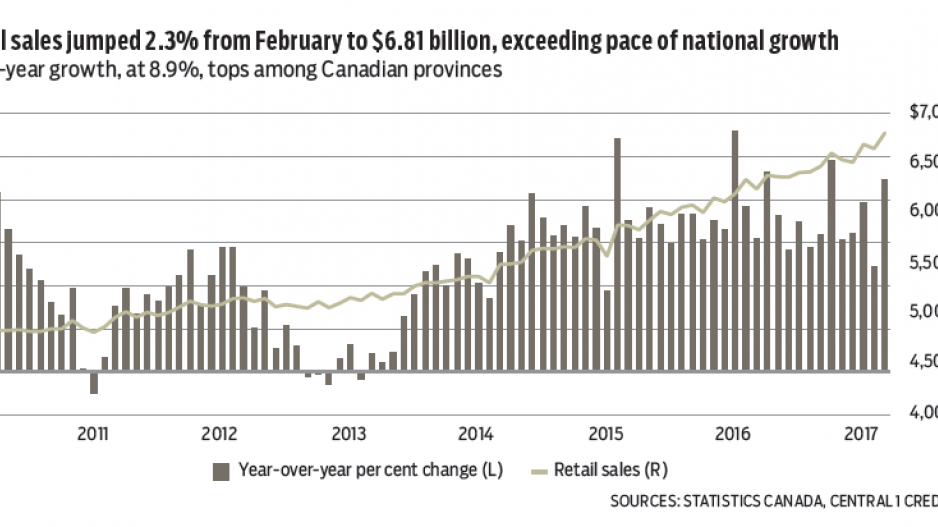

Retailers posted a surprisingly strong sales gain in March, underscoring the strength in consumer demand in B.C. driven by a strong labour market, population growth and housing market. With gains in nearly all segments, dollar-volume sales jumped 2.3% from February to a seasonally adjusted $6.81 billion. This exceeded national sales growth of 0.7% but trailed Saskatchewan, New Brunswick and Prince Edward Island.

That said, year-over-year growth was tops among provinces at 8.9%, marking an acceleration from 4.9% in February, with gains both inside and outside Metro Vancouver. A rebound in motor vehicle-related sales after a February contraction provided much of the lift, but gains were broad among segments, with home improvement store sales significantly higher. Gasoline sales growth also accelerated to 26% year-over-year, but was primarily due to higher prices.

Year-to-date growth of more than 6% has been well dispersed in the province, with a 5% increase in Metro Vancouver and even stronger gains in the rest of the province (7.5%). This aligns with improved labour market conditions in other regions.

Annual retail sales are forecast to settle near 5% this year from more than 7% in 2016, due in part to peak vehicle sales. Adjusting for retail price inflation, real retail spending of 3% is forecast.

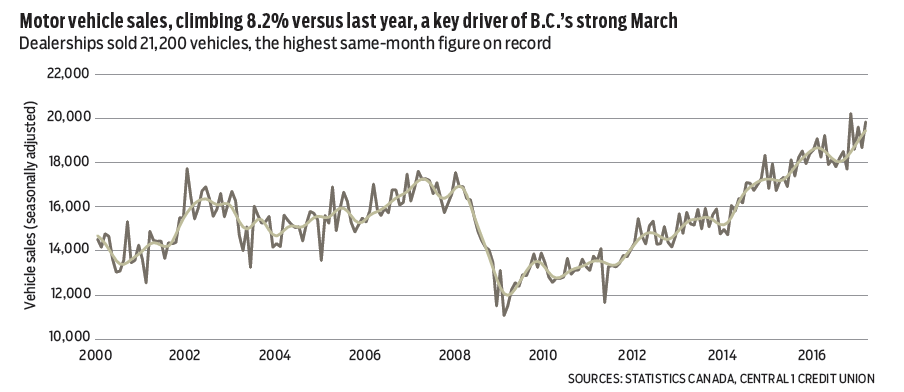

Motor vehicle sales were a key driver of retail strength in March, and reflected a rebound in new vehicle sales to cyclically high levels. After a February pullback of 1.7%, year-over-year sales growth climbed 8.2% in March. The more than 21,200 vehicles sold in March marked the highest same-month sales performance on record and lifted first-quarter sales growth to 4.3% from the same period in 2016. Further upside to vehicle sales is limited given the current elevated pace.

Meanwhile, tourism demand remained strong with a near-record pace of international tourist visits to B.C. in March due to the Canadian dollar’s weakness and a comparably stable political environment. Total visitor entries to B.C. edged down again from recent highs to 469,785 persons (seasonally adjusted), marking a 0.4% decline from February. U.S. visits were unchanged from February, while overseas visits declined 0.9%.

Despite the March dip, B.C. continues to rely on momentum in overseas visits to drive tourism growth. Through the first quarter, total tourist visits were up 1.5% from same-period 2016, driven by a 10% increase in overseas visits, while U.S. entries fell 2.7%. Of the former, gains were led by increases from Australia, Mexico, China and India. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.