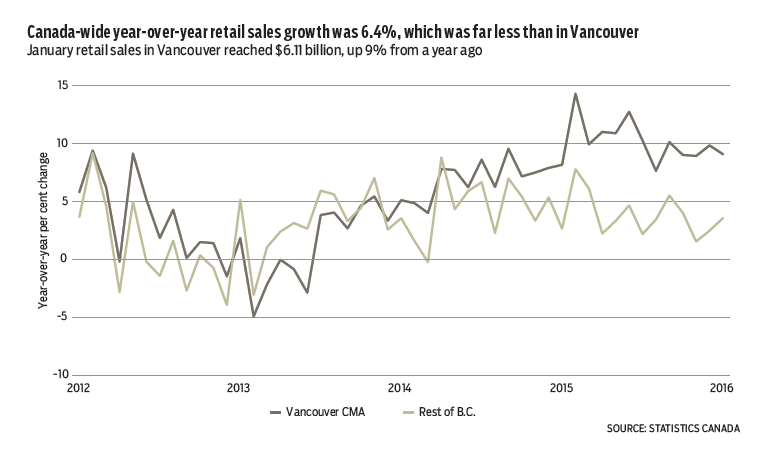

Alongside most other provinces, B.C. posted a strong pickup in January retail sales after a December pullback. Sales reached a seasonally adjusted $6.11 billion, up 2.3% from December and 9% from a year ago. Nationally, month-to-month growth was similar at 2.1%, with a year-over-year increase of 6.4%.

B.C.’s monthly gain was lifted by gains in electronics and appliance sales, health-related products and general merchandise, as gasoline purchases declined. On a year-over-year basis, most retail store segments are well ahead of a year ago, led by building materials and garden equipment (14.6%), motor vehicles and parts (8.6%), furniture and furnishing (10.2%), health-related products (15.8%) and clothing (10.1%).

January’s positive report has B.C.’s retail sector back on the upward growth track that extends back through 2014, suggesting another consumer-led growth story for 2016. Gains have largely been driven by Metro Vancouver, which has trended at a year-over-year pace of about 9% over the past six months.

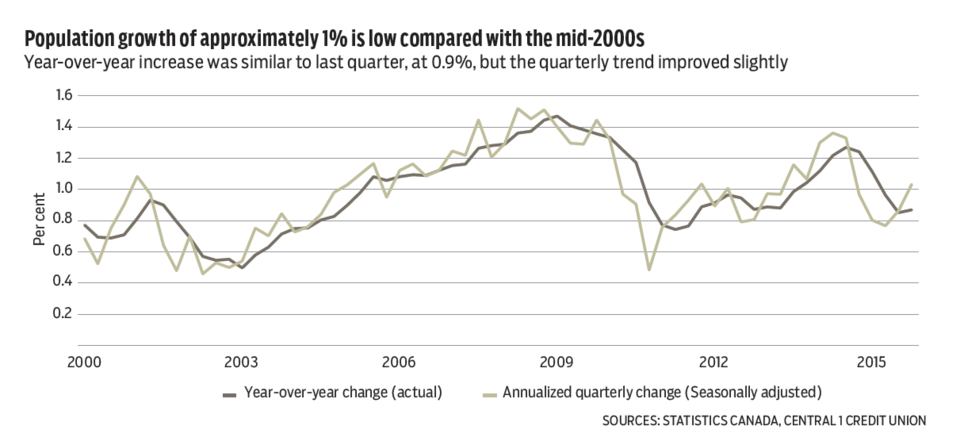

B.C.’s fourth-quarter population growth remained subdued, according to Statistics Canada estimates. As of January 1, B.C. was home to an estimated 4,707,021 people – a gain of 3,082 from October and 40,575 from a year ago. While year-over-year growth was similar to last quarter at 0.9%, the quarterly trend improved slightly to a seasonally adjusted annualized pace of 1%, which was the highest since 2014’s third quarter. Nonetheless, growth remained disappointingly low compared with trends in the mid-2000s, although a closer look points to some positive nuggets of news that bode well for the economy.

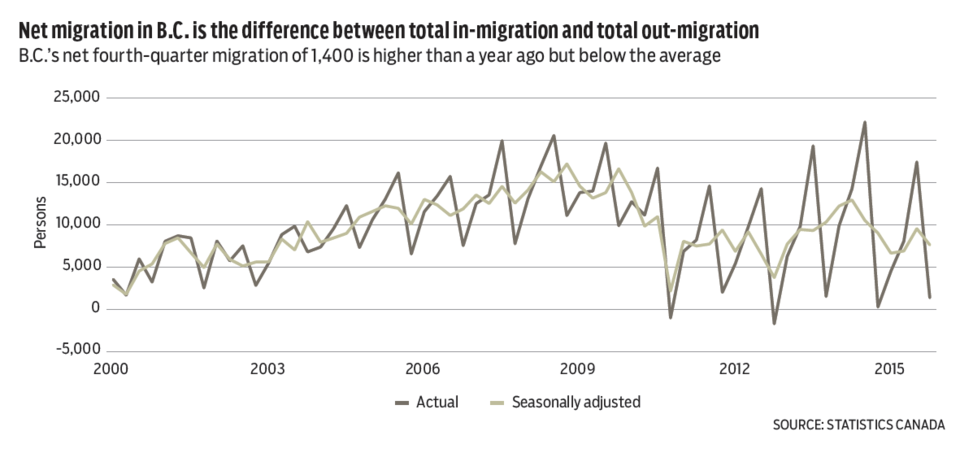

Net migration was slow in the fourth quarter at 1,400 persons. While sharply higher than a year ago (up from 300), this was well below the average fourth-quarter net migration observed since 2000 of more than 4,000 people, reflecting a sluggishness that is also evident in low seasonally adjusted trends.

Weak growth reflected net international immigration, which quarter-over-quarter was negative. Once adjusted for normal seasonal patterns, it was second-lowest since 2000, but analysis of the components paints a brighter picture. Almost the entire decline reflected a sharp drop in the number of net non-permanent residents (8,157 quarter-over-quarter), while the flow of landed immigrants – more important for economic growth through long-term consumption, income and investment channels – has rebounded after exceptionally weak levels from mid-2014 to mid-2015.•

Bryan Yu is senior economist at Central 1 Credit Union.