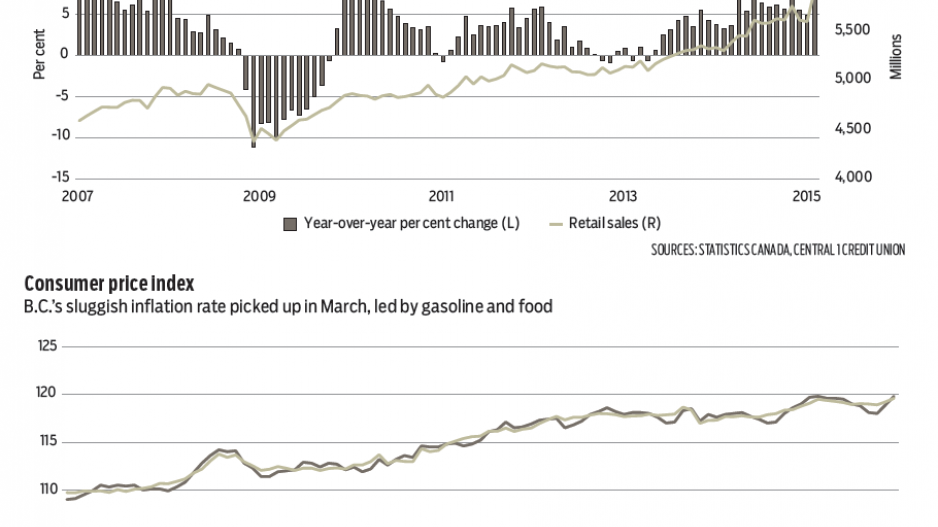

“Spectacular” is a word that comes to mind with February’s retail sales data. Retail sales in B.C. surged 5.9% from January to a seasonally adjusted $5.92 billion – the largest month-to-month gain since the mid-1990s – and marked a near 12% increase from the same month in 2014. This comes despite a near 14% year-over-year drop in gasoline sales. In comparison, national retail sales growth was 1.7%, month-to-month, with a year-over-year gain of 2.5%.

Rising housing market activity was a driving force of the uplift. From our estimates, sales of electronics and appliances and building materials surged by more than 7% from January. Housing-related sales as a whole, which also includes furniture and furnishings, were 24% higher year-over-year in February. Motor vehicle sales were up 21% from a year ago. February’s powerhouse performance lifted year-to-date growth to 8.1%, albeit owing mostly to an 11% increase in Metro Vancouver. Retail gains reflect improvements in the economy. Retailers are also benefiting in part from the lower Canadian dollar. While import costs are on the rise, there is less leakage to the U.S. as shoppers stay nearer to home, given the less favourable exchange rate. February’s lift is expected to be a one-off, and a pull-back in March would not surprise. Nonetheless, retail sales growth is anticipated to remain strong this year at nearly 4%.

Consumer price inflation in B.C. picked up in March after trending near 0.8% over the previous two months. Year-over-year growth in the consumer price index climbed to 1%. A slide in the underlying price trend observed since mid-2014, and owing largely to gasoline prices, has turned around over the past two months.

At 1%, broad inflation remains low, but certain products and services are significantly higher than a year ago. Food prices are up 3.6% from the same month in 2014, owing largely to meat and vegetables, which are up 10%. Grocers are being pressured by the rising cost of imported produce owing in part to the low Canadian dollar. Sector competition and appropriate exchange rate hedges are limiting some impact for the consumer, but higher costs are undoubtedly filtering through. Meanwhile, clothing prices are up 3.1%, partly for similar reasons.

Despite some recent uplift, gasoline prices remain a drag on inflation and were down 12% from a year ago. Aggregate shelter costs were up a scant 0.4%, with costs related to owned accommodations eased.

Bryan Yu is senior economist at Central 1 Credit Union.