Canada’s insolvency rate has risen for the first time since the recession, according to a report released Tuesday (May 19) from CIBC Economics.

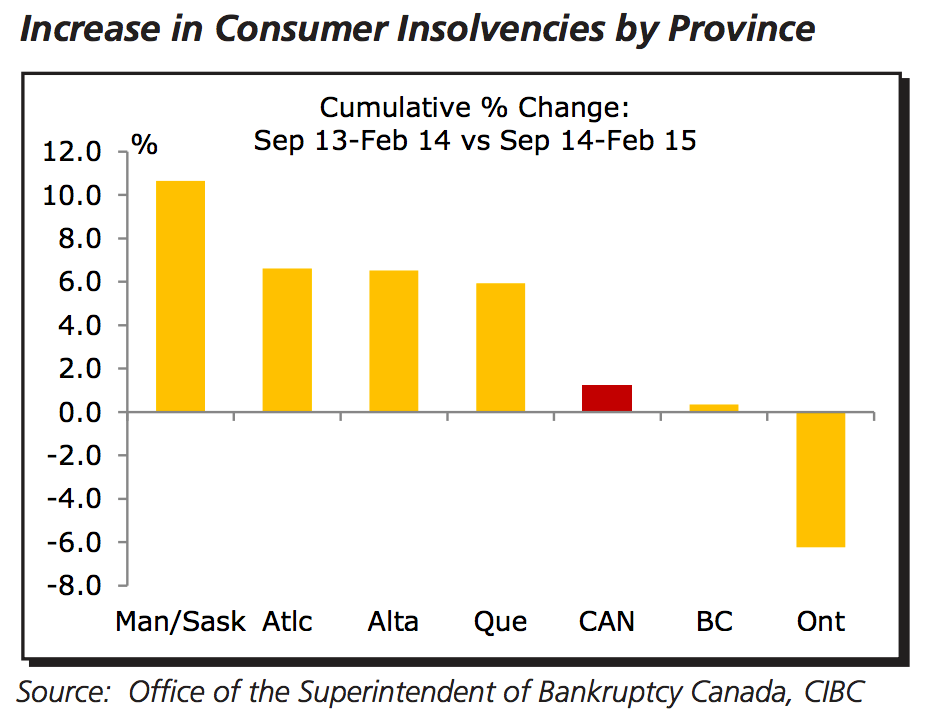

Insolvencies across the nation rose by 1.2% during the six months ending in February, however, the study revealed the rate has remained virtually unchanged in B.C. during that period.

Instead, provincial economies heavily invested in the oil sector have been hit hard.

The insolvency rate in Alberta rose 6% during the six-month period examined, while the rate rose nearly 11% in Manitoba and Saskatchewan.

“The damage from lower oil prices is starting to show,” CIBC economist Nick Exarhos wrote in the report.

“Zooming in on the situation in Alberta, there are reasons to believe that the coming quarters will see continued deterioration.”

He added more than half of insolvencies occur from a combination of overextended credit, poor financial management and unexpected expenses.

“Given the increased sensitivity of Canadian households to higher interest rates, it is reasonable to expect that, as opposed to previous cycles, the upcoming interest rate tightening cycle will lead to a moderate increase in the insolvency rate, as the negative impact of increased debt financing costs will offset any positives on the unemployment front,” Exahros wrote.

But the report noted insolvency rates tracks two important components: personal bankruptcies and proposals (efforts to renegotiate or repay a portion of debt).

The number of personal bankruptcies has actually fallen by 4.7% during the six months ending in February. Instead, the rate of proposals has risen 9%.

“While proposals rose alongside bankruptcies during the recession, they stayed high during the recovery,” the report said.

“That was largely due to changes to the Bankruptcy Insolvency Act (BIA) in 2008 with the most significant modification being the increase in the limit of the size of non-mortgage debt for qualifying for a proposal from $75,000 to $250,000 — making proposals more attractive relative to the bankruptcy route.”

@reporton