The B.C. government’s surplus soared to $1.68 billion, or nearly $1.3 billion more than anticipated in the 2014-15 fiscal year, B.C. Finance Minister Michael de Jong announced July 15.

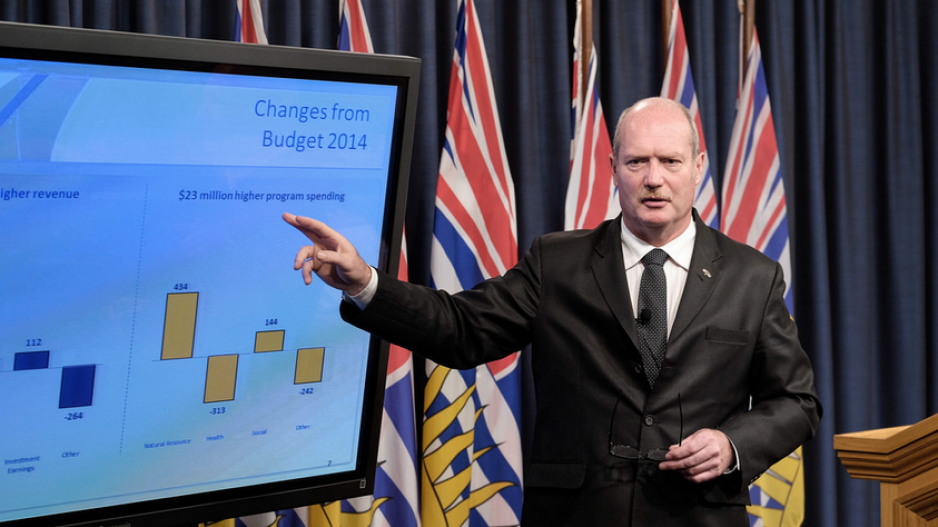

The higher surplus came thanks to a combination of about $1.3 billion more revenue than expected while expenses were only $23 million more than forecast.

“The province is on a steady and firm fiscal path,” de Jong said.

Despite that good news, the total provincial debt rose. That's explainable because the government keeps two budgets: an operational budget and a capital budget. The operational budget saw the surplus whereas the capital budget ate that surplus.

Higher than expected revenue came from taxes and stronger profit at self-supported Crown corporations, de Jong said. Less money, however, flowed from the federal government and other revenue streams such as natural resource revenue.

Total debt climbed by $2.2 billion to $62.9 billion. The good news is that this is $1.8 billion less than earlier forecasts.

The hike in total indebtedness was largely because of capital projects such as:

•redeveloping the Vancouver’s B.C. Children’s and Women’s Hospital and the Surrey Memorial Hospital emergency department and critical care tower;

•replacing Oak Bay Secondary;

•planning and preparing for the George Massey Tunnel replacement; and

•Highway 1 improvements.

De Jong said that the B.C. economy grew at a 2.6% rate, which is higher than the Canadian average of 2.4%.

He sounded a word of warning about the future, however.

“While our fiscal position last year was strong, we continue to see ongoing challenges in Canada, the U.S., and our major trading partners,” he said.

“This means we must continue to be disciplined and sustain our commitment to only spend on programs what taxpayers can afford to contribute.”

NDP finance critic Carole James was not available for comment by press time.

As for spending, it increased.

The amount spent on education during the year stayed flat at about $11.8 billion. Other areas saw hefty hikes.

For example, the government spent:

•$508 million more on healthcare;

•$436 million more on natural resources and economic development, primarily to put out wildfires, funding to encourage LNG, the environment and economic development; and

•$42 million more on social services.