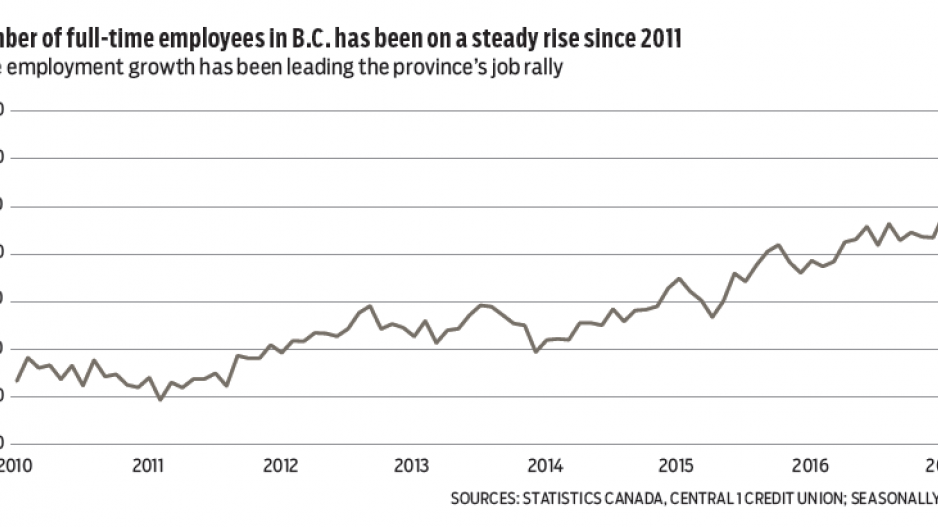

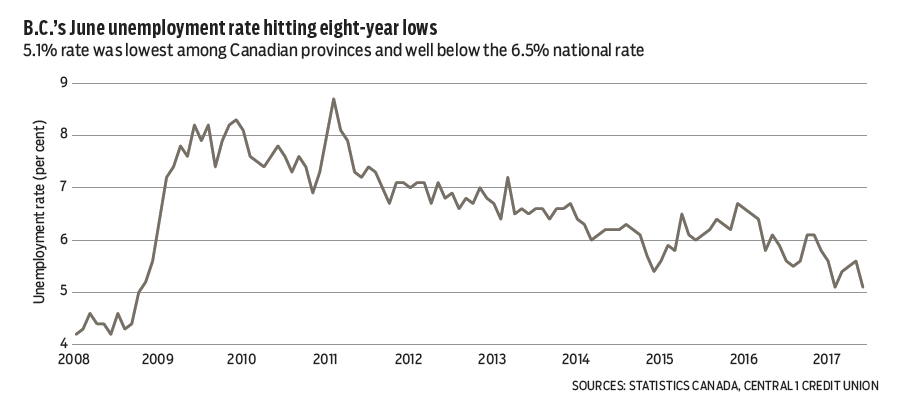

Yet another surge in B.C. hiring in June provided a strong labour market hand-off to the second half of the year while pointing to continuation of the robust economic growth cycle. Led by full-time gains, total employment shot up 0.8% or by 19,700 persons compared with the tally in May. This far exceeded the national increase of 0.2% over the period. B.C.’s unemployment rate fell to 5.1% from 5.6% in May.

The Vancouver census metropolitan area was the key growth driver, with employment rising 1.3%. Unemployment fell to 4.7% of the labour force from 5.5% in May.

Among industries, goods-producing sectors contributed the bulk of the gain, with high levels of housing construction and rising exports lifting construction and manufacturing employment.

First-half employment growth rose to 4%. A strong economic cycle tracking about 3%, higher levels of business confidence, demand for existing homes, new construction, tourism and rising exports have contributed.

Alongside the low unemployment rate, the employment rate of the working-age population was, at 62.5%, the highest since mid-2008, pointing to near capacity in the labour market and high engagement of the workforce.

Annual employment growth is forecast at more than 3%, with an unemployment rate of 5.3%.

The Lower Mainland housing market remained strong in June with elevated sales and further price appreciation. Multiple Listing Service sales reached 6,420 units during the month, and while down 11.3% from same-month 2016, the cycle has rebounded from the shock of the foreign-buyer’s tax. Year-over-year declines largely reflect stronger-than-normal sales in 2016’s first half.

Meanwhile, inventory has remained constrained despite a rise in new listings, with near record-low active listings despite rising 5% from a year ago. While the market favours sellers, conditions are especially tight for condos and townhomes. Strong demand and low inventory are driving sales-to-active-listings ratios to unprecedented highs and causing rapid price escalation. The detached market remains relatively balanced.

The composite benchmark value rose 1.9% from May to $896,000, and 9.5% from a year ago. Apartment condo prices have surged, with a near 2.8% monthly gain and a 20% year-over-year increase. Townhome prices rose 1% from the previous month and 13.6% from a year ago. Detached-home price growth was a modest 3.8% from a year ago, reflecting weaker demand in the latter half of 2016. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.