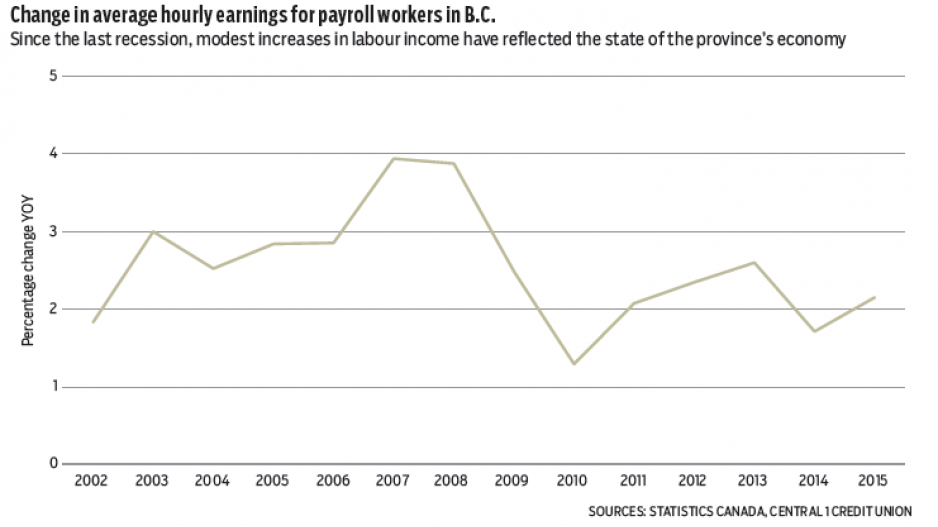

Since the last recession, modest increases in labour income have reflected the state of B.C.’s economy and labour market. The latest data on average hourly earnings for all payroll employees shows no material change, despite consecutive yearly declines in B.C.’s unemployment rate to below 6% this year.

Statistics Canada’s fixed weighted-average hourly earnings index is up 2.2% so far this year to June. This is higher than last year’s below-trend gain but roughly equal to increases in the prior three years. Examining trends by industry reveals below-average performance this year in some service-producing industries such as accommodation-food, arts-entertainment-recreation and education. Above-average gains occurred in real estate, construction, manufacturing and forestry.

Changes in labour market conditions and the returns to labour usually operate with a time lag, which implies there will be faster increases in the near future. In the prior decade when the unemployment rate fell below 5%, average hourly earnings were rising between 3% and 4% annually. Increases in earnings depend not only on the unemployment rate level but also on how fast it declines and whether it declines due to employment growth or to labour supply issues.

B.C.’s labour market since the recession has operated under weak employment growth and a declining labour force participation rate. Employment growth has averaged less than 1% annually since 2010, and the participation rate is lower by almost three percentage points.

One benefit of this year’s lower inflation rate is a gain in real or inflation-adjusted earnings. The consumer price index is running at less than 1% this year, resulting in a modest real earnings gain of just over 1%. Real earnings gains have played out each year since 2010 on this basis. Our outlook for the B.C. economy and labour market sees a continuation of recent trends for the rest of the year and into next year. Labour market conditions are expected to tighten by 2017, which will push up increases in nominal and real average hourly earnings.

Statistics Canada’s Survey of Employment, Payrolls and Hours (SEPH) provides an alternative source of employment estimates from the more-often-quoted Labour Force Survey (LFS). According to SEPH, payroll employment in B.C. is up 2.3% so far this year compared with a 0.3% decline according to the LFS.

SEPH is based on a census of payroll deductions provided by the Canada Revenue Agency, and the Business Payrolls Survey, which collects data from a sample of 15,000 businesses nationally. The LFS is based on a sample survey of households. •

Helmut Pastrick is chief economist for Central 1 Credit Union.