With a strong labour market showing in February, B.C.’s economy looks to be regaining momentum after a late-2015 lull. Following a subdued pace since October and a mild January uptick, B.C. employment climbed by 14,100 persons to 2.35 million persons – up 0.6% from the previous month and up 3% from a year ago. Nationally, there was no change from January, with year-over-year growth a mild 0.7%. B.C. unemployment was steady at 6.6%, but up from 6.1% years ago on higher labour force participation.

February’s strong monthly increase points to a growing economy, but the story is tempered by a loss of full-time jobs and mixed performance among cohorts. A drop in full-time employment of 0.3% was more than offset by a 4.1% gain in part-time employment but suggests some erosion in job quality. Among gender and age groups, youth and males aged 25 and over captured most of the employment gains.

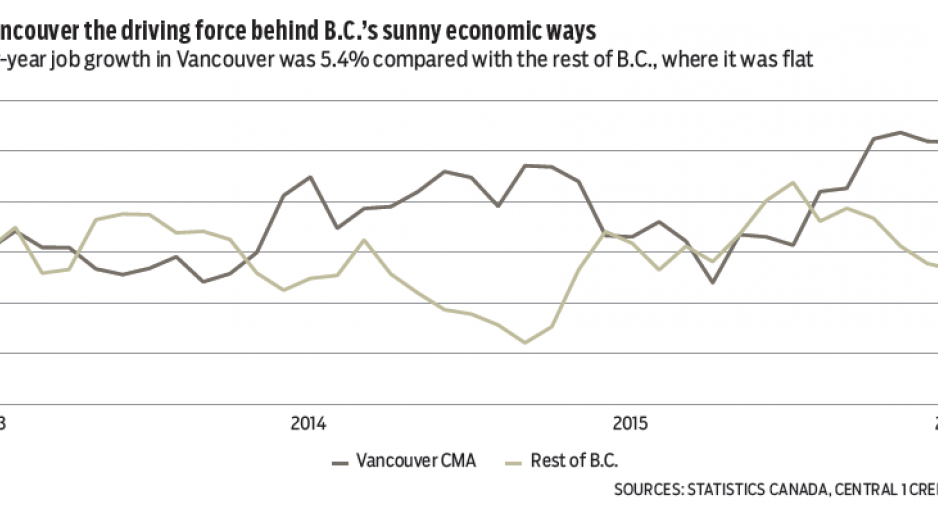

Hiring momentum is not provincewide. Metro Vancouver is the driving force of B.C.’s sunny economic ways. While monthly growth was similar in both the Vancouver census metropolitan area and the rest of the province, year-over-year growth in the former was 5.4% in February with a zero gain in the rest of the province. Outside the Lower Mainland-Southwest and Vancouver Island, employment is down in all regions, reflecting struggles with low commodity prices, the downturn in mining and the weak Alberta economy.

An upward trend in the unemployment rate reflects the dual nature of the provincial economy. On the South Coast, higher employment growth drives higher labour force participation as more disengaged out-of-work individuals seek employment, while job losses are the key factor in other regions.

Housing construction surged in February, with monthly starts that are among the highest levels in 25 years. Urban-area housing starts broke sharply from the trend of about 31,000 units to reach a seasonally adjusted annualized rate of 50,800 units, up 60% from January and more than double a year ago. In Metro Vancouver, annualized starts reached 37,200 units – a 68% gain from January.

The gain was attributed to a flurry of major apartment projects breaking ground during the month. About 90% of the monthly increase came in the multi-family market. Multi-family starts climbed 81% from January, with single-family construction up 17%. Canada Mortgage and Housing Corp. data shows a large uplift in Burnaby, which could reflect advancement of major projects including the Brentwood Town Centre and Station Square residential redevelopments. Kelowna also posted a strong gain. •

Bryan Yu is senior economist at Central 1 Credit Union.