B.C.'s job market posted a negligible employment gain to start 2016 following two down months. January employment edged up by only 1,200 or 0.1% to a seasonally adjusted 2.3 million persons but still outpaced the national dip and contributed to a lower unemployment rate of 6.6%, down from 6.7% in December.

January’s performance added to the subdued pace of job growth since October but masked a substantial monthly gain in full-time employment of 0.6% (10,700 jobs), that offset declines in part-time work. Even with weaker growth in recent months, B.C. led all provinces in year-over-year employment gains in January at 2.1%, reflecting moderate economic growth, compared with 0.7% nationally, which was dampened by job losses in the Atlantic, Saskatchewan and Alberta. Provincial gains have largely been led by manufacturing, information, culture/recreation and education, which in part reflects improving export conditions and expansion in tourism and high-tech. Not surprisingly, natural resources are faring poorly.

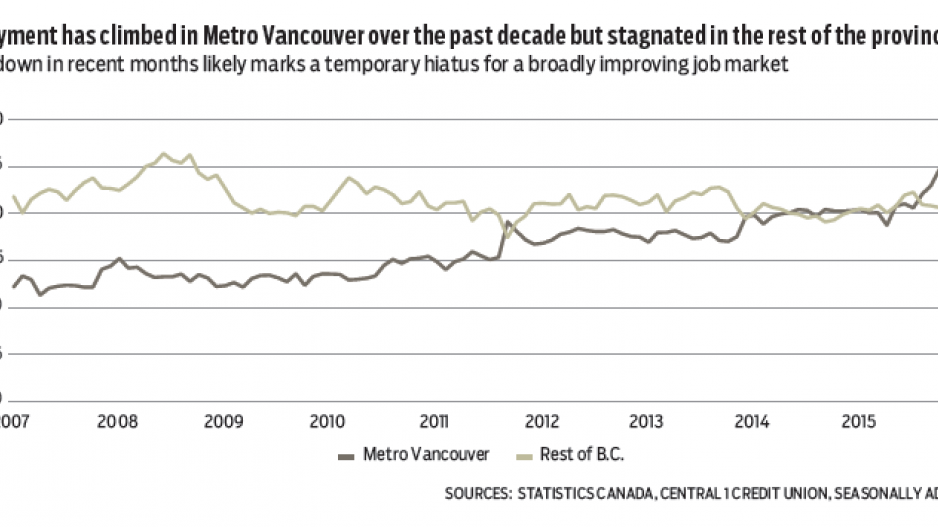

Metro Vancouver led the provincial gain with job growth surging at a year-over-year pace of more than 4% since October.

A higher unemployment rate, which was up a percentage point from a year ago, reflects higher labour force participation and signals improved labour market prospects for job-seekers. Dovetailing with soft employment was deterioration in small-business confidence, according to the latest results from the Canadian Federation of Independent Business Business Barometer survey.

While B.C.’s economy is doing relatively well and confidence is higher than in most provinces, sentiment has understandably waned with a flurry of negative news, including weaker expectations for global and national growth, volatile equity markets and the pummelling of the Canadian dollar.

B.C.’s confidence index on a scale of one to 100 fell to 62.8 points in January, down three points from December and nine points from a year ago. A reading above 50 means that the number of businesses expecting their performance to be stronger over the next year exceeds those with a negative outlook.

While the year-over-year drop was among the sharpest in the country, the level points to modest optimism behind only Newfoundland and Labrador and Nova Scotia. With a reading below 30 points, businesses in Alberta remain the most pessimistic, which is the primary contributor to a national reading of only 54 points. •

Bryan Yu is senior economist at Central 1 Credit Union.