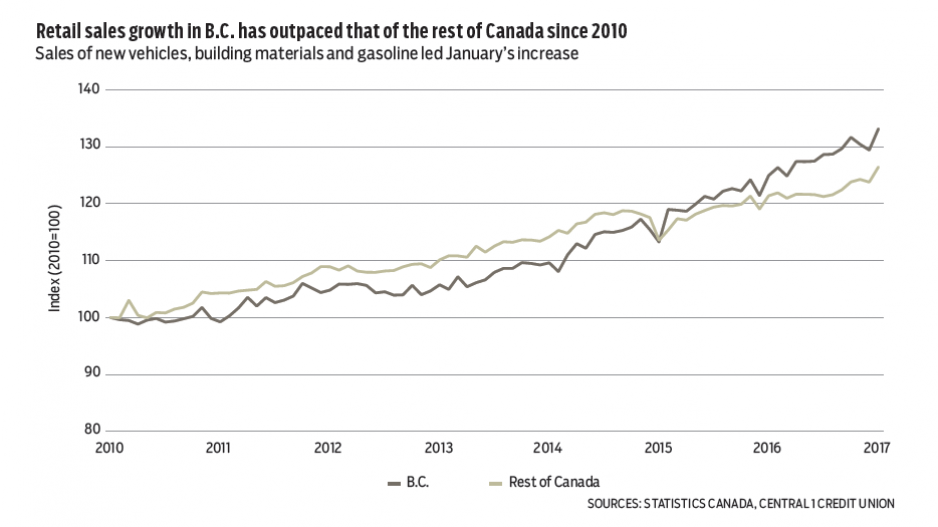

B.C. retail sales rebounded in January after a two-month slide to re-establish the upward pattern observed for most of last year. Dollar-volume sales climbed 2.9% from December to a seasonally adjusted $6.47 billion with year-over-year growth at a hefty 6.6% to outperform the country as a whole. Adjusted for price levels, year-over-year growth in B.C. was about 4%.

January sales are more indicative of the underlying trend. Previous months’ sales were likely dampened by the more challenging winter conditions. Meanwhile, with Black Friday madness increasingly a staple in Canada, holiday sales are being shifted earlier in the year. Seasonal adjustments based on historical trends may be insufficient and underestimate strength.

Among retail segments, a rebound in new vehicle sales and building materials underpinned January’s increase, while higher gasoline prices also contributed to headline gains. Our measure of core retail sales growth, which excludes the volatility of gas and vehicle sales, tracks a lower but still moderately strong pace and points to healthy consumer demand.

Similar year-over-year gains were observed in the Vancouver census metropolitan area and the rest of the province. While further breakouts are unavailable, population growth, strengthening labour markets and tourism demand mean growth outside of Metro Vancouver was likely concentrated in Victoria and Kelowna.

Retail sales growth is forecast to maintain a healthy 5% pace, with inflation-adjusted gains in the 3.5% range.

Meanwhile, a low Canadian dollar and favourable geopolitical situation have underpinned the surprisingly strong and sustained uptrend in tourist inflows. Levels have surpassed 2010 Winter Olympics inflows, and, going further back, are approaching Expo 86 levels, albeit with far less economic impact given expansion in the economic and population base.

January international tourist inflows to B.C. rose 0.6% from December to a seasonally adjusted 483,530 persons, marking an 8.3% year-over-year gain. Overseas visits underpinned growth with a nearly 18% increase from a year ago, while U.S. visits climbed 3.5%.

Although U.S. visits have rebounded in recent years, momentum has been driven by record-high overseas visits. U.S. inflows still dominate the flow but recent overseas visits trend 35% higher than the pre-recession high in 2008. China accounts for most of the gain, although there have been substantial increases in visits from residents of countries like Taiwan, South Korea, Mexico, Australia and the U.K. •

Bryan Yu is senior economist at Central 1 Credit Union.