Retail spending continued to ramp up at B.C.’s storefronts with yet another strong showing in June as growth in the housing market, tourism and general economic activity lifted consumption.

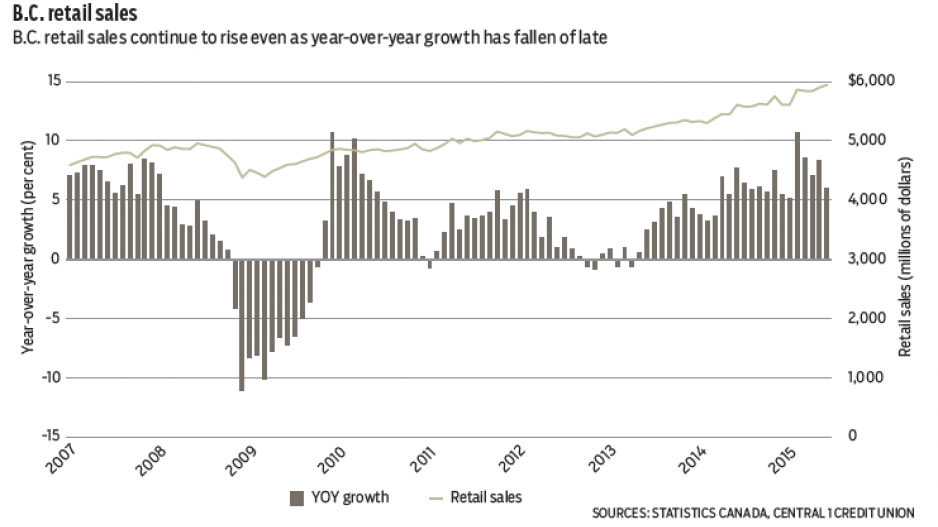

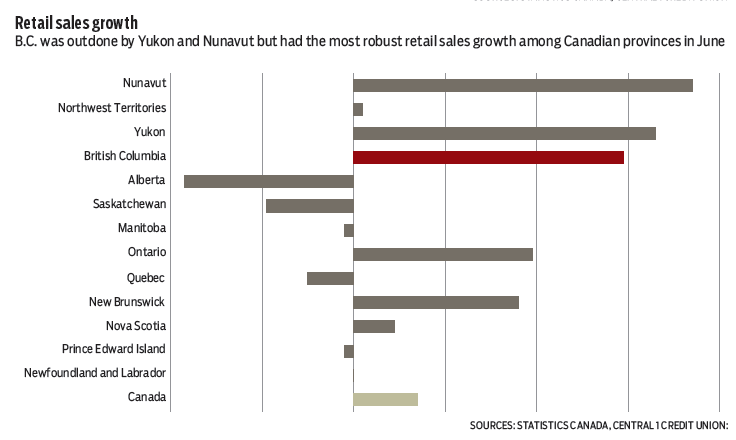

Despite a pullback in auto-related sales, dollar-volume sales climbed 0.7% from May to a record-high $5.94 billion in June, marking a robust 5.9% increase from the same month in 2014. While monthly growth decelerated from May and was in line with the national reading of 0.6%, year-over-year sales growth in B.C. remained highest among provinces.

National same-month sales growth was a modest 1.4%. Ontario growth was a distant second to B.C. at 3.9%, while sales contracted in Alberta, Saskatchewan and Quebec – owing in large part to the effects of the oil shock.

Year-over-year sales growth continued to reflect increases in housing and other interest-rate-sensitive sectors. The building materials and garden equipment sector posted a 26% gain, with sales at home furniture/furnishing stores up 15%. Despite a monthly pullback, vehicle-related spending was up 8%. More broadly, all retail sectors posted significant sales uplift in June, with the exception of gas stations, which are down due to lower fuel prices.

Positive momentum has pushed year-to-date sales to a robust 7.5% through mid-year, led by a gain of 11% in Metro Vancouver compared to a modest 4.3% elsewhere in the province. With retail price levels in line with a year ago, most of this gain reflects an increase in real spending in the economy. Total full-year retail spending growth in B.C. is forecast to reach 5% this year and hold steady at 5.5% in 2016.

In line with this week’s retail report, B.C. new vehicle sales remained elevated in June but growth slowed to a year-over-year pace of 3%, down from 5% in May. Since peaking earlier in the year near 18,000 units, seasonally adjusted sales eased to 16,400 units in the latest month, marking a 3% dip from May and a second consecutive monthly decline. Through the first half of the year, sales are up 8%.

Despite recent declines, new vehicle sales continue to trend at a healthy pace that’s in line with pre-recession levels, although population-adjusted sales remain lower. Higher demand for autos in the province reflects a period of low interest rates, economic expansion, population growth and replacement demand that will continue to underpin sales growth. •

Bryan Yu is senior economist at Central 1 Credit Union.