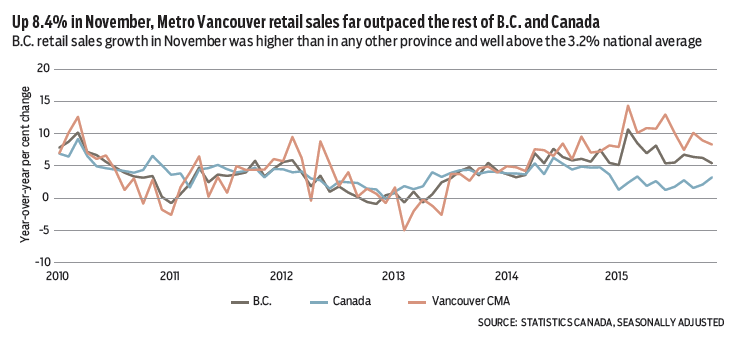

In line with gains across most provinces, B.C. retail sales jumped in November as retailers ripped a page from the U.S. playbook with ramped-up Black Friday offerings.

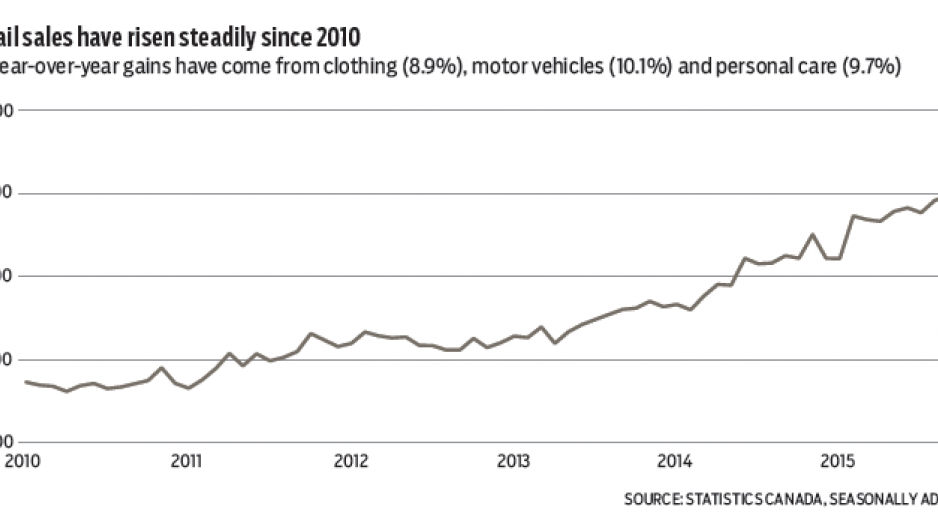

Following a flat October, B.C. dollar-volume retail sales climbed 1.8% to a seasonally adjusted $6.06 billion, which was slightly above the 1.7% national gain.

While early holiday sales boosted gains, sales continued to trend well ahead of a year ago with growth of 5.4% on a November-over-November basis, and outperformed the nation as a whole. Metro Vancouver sales were up 8.4%. Growth was broad among stores, with the strongest year-over-year gains found in clothing and accessories (8.9%), motor vehicles and parts (10.1%), health and personal care (9.7%) and building materials/equipment (20%).

November’s strength added to the trend that pushed year-to-date sales to 6.7% – the highest among provinces, compared with a 2% national gain.

Saskatchewan and Alberta were both down about 3%. Relative strength in B.C. dovetails with growth momentum in 2015 and reflects improved hiring and housing activity and a strong inflow of tourists. Central 1 Credit Union forecasts full-year retail sales growth of about 4% this year and 5% in 2017.

Headline price inflation in B.C. was the highest in four years in December as rising food prices and the diminished effect of low energy prices lifted prices from a year ago. B.C.’s consumer price index (CPI) climbed 1.9% from a year ago, with seasonally adjusted prices showing acceleration in growth over the last two months.

Food prices were a key contributor, climbing 4.5% year-over-year, compared with 4.3% in November.

The low Canadian dollar and California drought have contributed to increased sticker shock in the grocery aisle.

While gasoline prices remained low, they were no longer a drag on CPI inflation during December.

The 4.4% year-over-year rise in gas prices was the first increase since June 2014. With the price at the pump down over the past month, gas is likely to be a positive but weaker contributor to CPI inflation in January. Other unwelcome news for consumers includes above-average growth in clothing and footwear and recreation prices.

A low Canadian dollar is driving import-price inflation for some goods and services.

For the year as a whole, CPI inflation averaged 1.1% in B.C., led by a slightly higher rate of 1.2% in Metro Vancouver. •

Bryan Yu is senior economist at Central 1 Credit Union.