Businesses across the country are feeling more optimistic about Canada’s economic outlook, according to the Bank of Canada’s latest Business Outlook Survey, released October 9.

Not all industries are equally positive, however, as weak commodity prices continue to exert pressure on energy firms.

“In a recent speech, Bank of Canada Governor Stephen Poloz noted that in the wake of low oil prices, the Canadian economy would have to look for other industries to drive economic growth,” said Diana Petramala, economist at TD Economics. “The Bank of Canada’s role is to help facilitate that adjustment.

“Indeed, today’s report underscores the view that other sectors of the economy would pick up some of the economic slack caused by the collapse in oil prices.”

Petramala noted that businesses in non-energy sectors expect to invest in machinery and equipment over the next year.

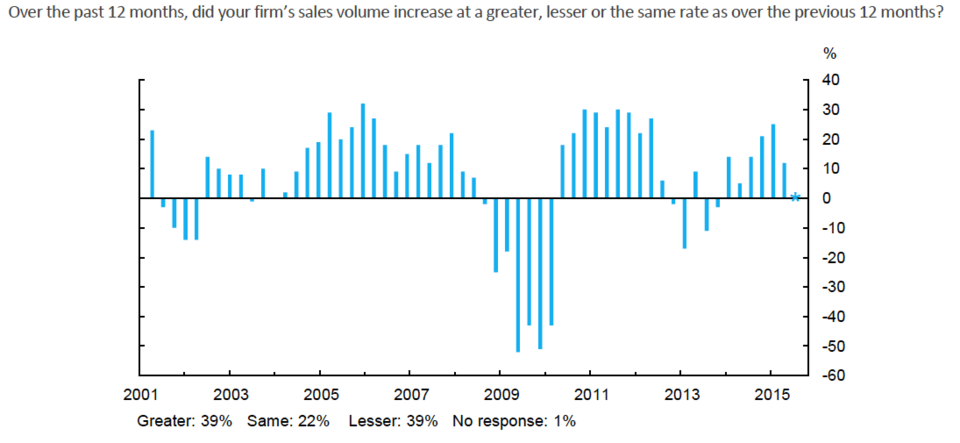

Sales have been flat over the past 12 months, businesses say, mostly due to poor results in energy-reliant areas.

Firms saw a flattening of sales growth over the past 12 months

Image: Bank of Canada

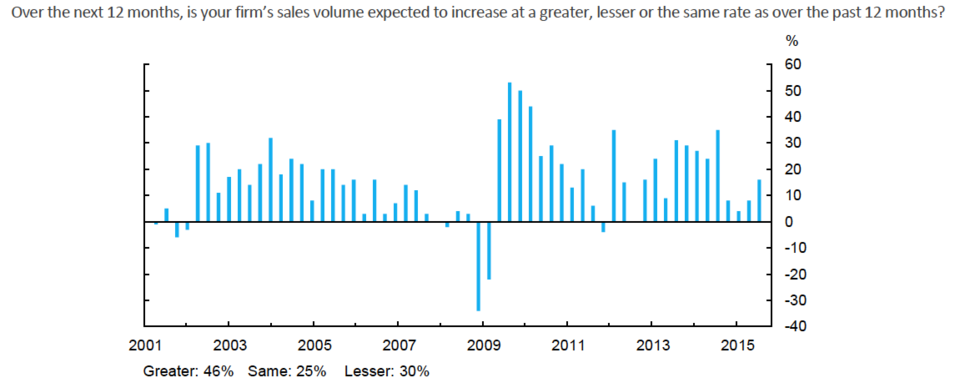

The outlook for overall sales and investment for the next year has brightened overall, however, as many expect growth over the next year.

Many companies expect acceleration in sales over the next 12 months

Image: Bank of Canada

Overall, analysts are saying the tone of the report is positive.

“The autumn Business Outlook Survey is slightly more upbeat than the summer report, suggesting that the worst is behind us,” said BMO Capital Markets senior economist and vice-president of economic research Benjamin Reitzes.

“The broad improvement in the survey points to modest growth in the second half of the year, consistent with our forecast of modestly above 2% GDP growth on average.”

Petramala agrees that the economy is recovering, but some challenges remain, she said.

“First, we continue to expect a modest pace of hiring due to a lagged impact of past weakness in real GDP growth, with the unemployment rate holding relatively lofty at around 7% through the next year,” she said.

“Second, the oil sector will continue to be a sore spot for the economy with oil prices remaining low.”

@EmmaHampelBIV