A friendly voice and the lure of a potential prize might be all the bait a criminal needs to gain inside information on your business. That was the experience at a Delta branch of a multinational company.

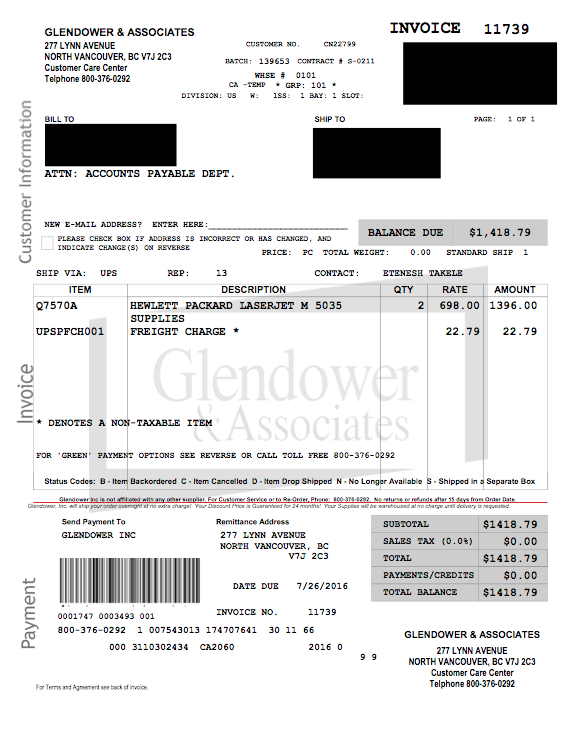

A caller from a seemingly legitimate company, Glendower & Associates, phoned an unwitting administrative assistant at the Delta business, claiming to be a service provider for its office printer. The fraudster was able to ascertain the printer’s serial number, which would soon be included on an official-looking invoice sent to the company demanding payment of just over $1,400. Along with the invoice was an offer of a gift card to the employee handling the invoice.

“Include your name and extension along with your payment of your invoice and you’ll receive your $100 Amex card direct to YOU overnight,” the offer promised.

This was not an isolated incident. According to the Better Business Bureau’s (BBB) website, businesses across Canada have received similar invoices from the fake company. Of the four cases reviewed by the BBB, three were in British Columbia. According to the BBB, the property managers of the addresses listed on the invoices confirm that Glendower & Associates is not a tenant of the properties they manage and no incorporation documents were found in the B.C. registry.

According to two recently released reports, economic crime targeting Canadian businesses is rising. However, B.C. appears to be taking the lead in reducing its frequency and damage.

In 2018, according to PwC’s 2018 Global Economic Crime and Fraud Survey, 55% of Canadian businesses surveyed reported experiencing fraud or economic crime in the past two years. That’s up from 37% in 2016.

A BDO report found that the value of fraud increased 78% to $30.4 million in 2017 compared with 2016.

Last year, Canadian businesses were defrauded of $18.6 million by phone and over the internet. According to BDO, merchandise fraud in Canada increased by 413% in 2017 from just $1.3 million in 2016.

PwC’s report noted that 38% of companies reported asset misappropriation, 36% had experienced customer fraud and 14% were targeted by procurement fraud similar to the fake invoicing that hit the Delta company.

Comparatively, only 8% of respondents reported money laundering in the last two years. While fraud is responsible for much of the economic crime across the country, money laundering has been singled out for enforcement efforts in British Columbia.

Earlier this year, B.C. Attorney General David Eby received a report compiled by former RCMP deputy commissioner Peter German that outlined 48 recommendations to reduce money laundering in the province, including increased police resources and information sharing.

“What I’ve seen is a serious increase in money laundering,” said Denis Gagnon, former RCMP officer and now a private investigator and president of British Columbia Specialized Investigations. “The people that look legitimate are the ones that arrange the purchase of the asset, and what happens constantly is that the source of capital isn’t checked nor can it be explained. So they’ll purchase something that appears to be legal, but the source of funds is not.”

Technology has a large role to play in the rise of fraud, money laundering and economic crime, Gagnon said.

“Sophistication is the key,” he said. “You’re not going to get someone breaking the front door like the old days; you’re going to get invaded through your screen or your smartphone. The [fraudsters] are very strong cyber experts, and this is why law enforcement always seems to be trying to catch up.”

The PwC report backs this up by warning that as more businesses go digital, more economic crime will follow.

Fake invoice issued by scam artists under the name Glendower & Associates | Credit: Submitted

Adherence to strict business safeguards can help thwart fraud artists. Even though the Glendower & Associates fraudsters were able to obtain a serial number, the Delta business’ internal processes – including an approved supplier database requiring a credit check and corporate approval – prevented the false invoice from being paid.

The PwC report noted that technology can be a double-edged sword and suggests using emerging technologies to prevent economic crime.

But Canada continues to lag behind the rest of the world in using technologies to combat economic crime.

Only 18.4% of Canadian businesses have proactive detection systems, and Canadian businesses perform data reviews of contracts 25.6% less often than the global average. •