If you’re looking for optimism, the Bank of Canada’s (BoC) summer Business Outlook Survey (BOS) is probably not the place to turn. Confirming Canadians' concerns about the shape of the economy, the Bank of Canada interviewed people in senior management from roughly 100 firms. What they found was that the transition away from an economy heavily dependent on growth from the energy sector continues to be slow.

“The summer BOS highlights that the Canadian economy remains in transition and the process is unfolding very slowly. The more restrained optimism on foreign demand isn’t what the BoC is looking for and suggests the transition will remain slow,” said Benjamin Reitzes, senior economist for the Bank of Montreal, in a note to investors.

According to those surveyed, labour shortages are less intense then they were a year ago. However 30% of respondents said that they would have some trouble meeting unanticipated demand and 5% said they would have significant problems.

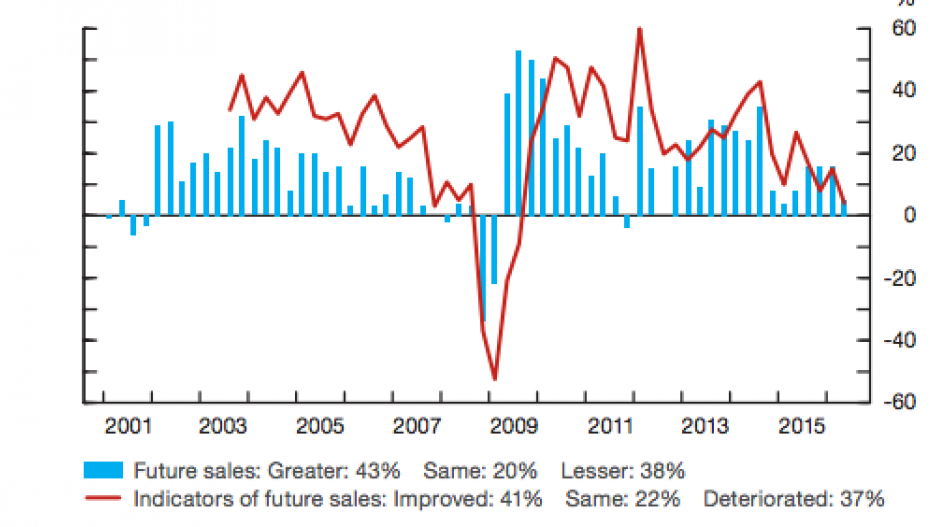

Expect a "marginal acceleration" of sales volume over the next 12 months, says the Bank of Canada, based on information gathered for its summer business outlook survey

Based on the survey investment on machinery and equipment is expected to increase 9%, the same amount expected last year. The economic drag is a result of weak commodity prices that depress the investment budget of those companies affected, primarily firms headquartered in the prairies. According to the BoC, investment intentions are being held back by modest domestic demand, uncertainty and insufficient foreign demand.

Hiring levels remain below the post-recession period, but more companies still intend to increase their labour force, with 43% of respondents saying they intend to increase their workforce and 22% believing their workforce will be smaller. The goods sector is expected to experience the greatest job loss with jobs coming from construction, manufacturing and energy.