Yesterday’s GDP report from Statistics Canada had economists cheering the return of growth to the Canadian economy, but the Bank of Canada’s Business Outlook Survey released April 1 provided a sobering caveat to this optimism.

Business sentiment has picked up over the past quarter, and firms’ optimism has increased since the central bank’s last survey released January 11 – but it remains “subdued overall.”“The fairly small improvement in sentiment reported in this morning’s Business Outlook Survey serves as a reminder that, yesterday’s strong GDP report notwithstanding, the Canadian economy remains in an adjustment period resulting from low commodity prices,” said TD Economics’ Brian DePratto.

In its report, the Bank said, “The positive impetus coming from sustained foreign demand continues to be largely offset by the persistent drag and spillovers from the oil price shock.”

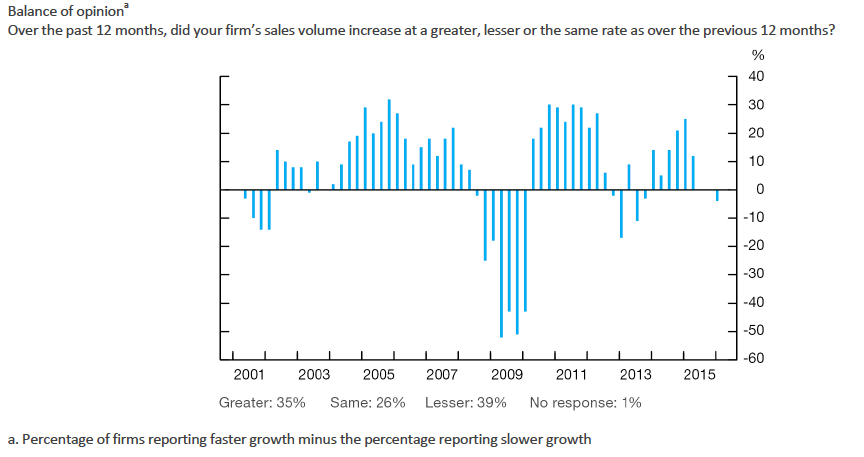

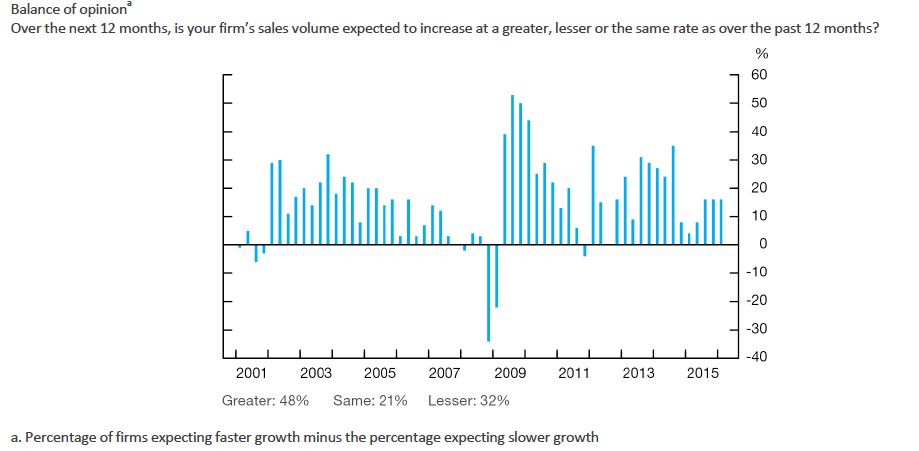

Firms report flat sales growth over the past year, made worse by low sales in firms tied to the resource sector. Overall, companies remain optimistic about sales over the upcoming 12 months, however, as they have for the past two surveys.

Firms saw a flattening of sales growth over the past 12 months…

…and expect an acceleration in sales volumes over the next 12 months

Strong foreign demand and a low Canadian dollar have buoyed expectations, and companies report an increase in advance orders and sales inquiries from foreign sources, which are expected to provide more growth than domestic customers.

The Bank said this sentiment diverges by sector.

“Although survey results suggest that the negative effects of the oil price shock are starting to level off, firms tied to the energy sector still face a difficult environment,” the report states.

“Several domestically oriented firms expect outright declines in their future sales volumes as the downturn in the commodity sector hampers broader business activity across regions and sectors.”

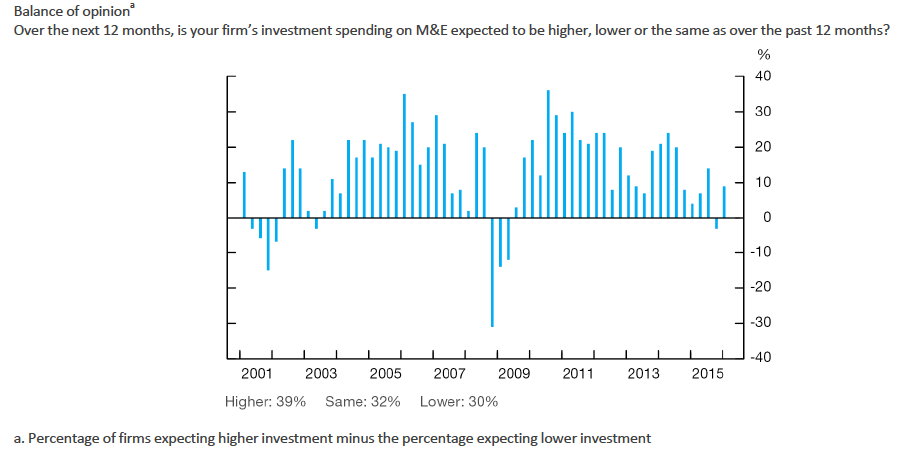

Investment intentions have moved into positive territory, increasing over the past quarter, from a negative 3 rating to a plus 9, which the Bank of Canada said is still “modest.” Again, these intentions differ by industry, and energy-based firms still report intentions to reduce investment. Poor domestic demand is also keeping investment plans low overall.

Firms’ investment intentions have increased but remain modest

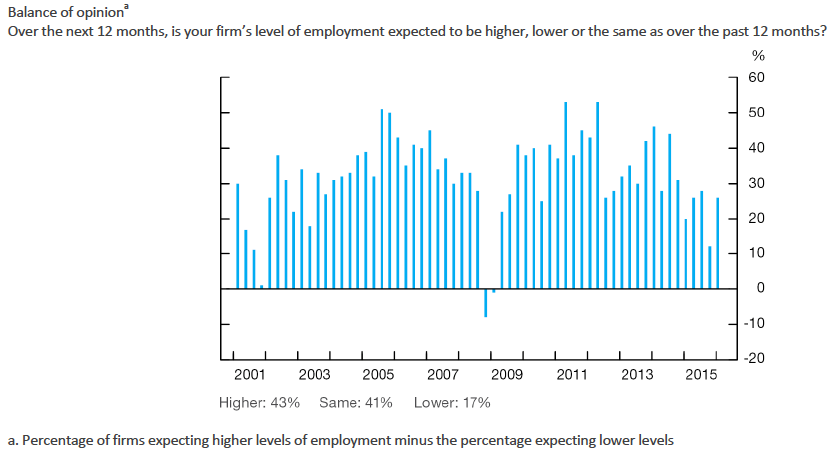

Employment intentions have increased since the last survey, but they remain below average. Exporters not related to commodities and service industries are most likely to say they plan to hire over the next 12 months, while hiring freezes and planned layoffs remain in the cards for energy-related firms, especially in the Prairie provinces.

Employment intentions have improved

“The implied outlook for investment and hiring this year are hardly cause for celebration, as both remain below their long-run averages,” DePratto said.

“Indeed, the survey provides support for our expectation that, beyond the first quarter, growth over the remainder of 2016 is likely to come in, on average, only slightly above the economy’s ‘cruising speed’ of 1.6%.”

@EmmaHampelBIV