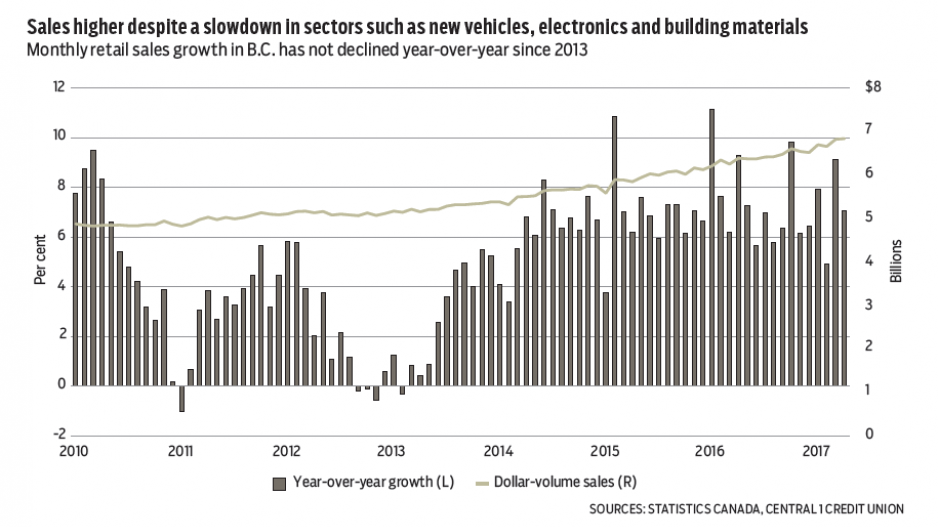

Strong consumer demand continued into April in B.C., with further gains in retail sales.

While a strong cyclical uptrend remained, dollar-volume sales growth decelerated to 0.3%, with $6.84 billion in sales. This was below the national increase of 0.8% and most other provinces. Year-over-year growth of 7.1% decelerated from March but was consistent with the national increase.

Momentum eased across most retail segments from March. Slower sales for new vehicles were a key drag, but the comparison was skewed by a sales surge the month prior. Notable slowdowns were also observed in housing-

associated retailers for electronics, appliances and building materials. That said, given strength in the retail trend and a strong prior-month performance, April’s growth deceleration is not concerning.

More telling is that year-to-date sales were still second-highest in the country at 6.2%, particularly impressive given that B.C. led the country in sales growth over the past two years and posted a 7.4% increase in 2016.

B.C.’s population trend, meanwhile, held steady in the first quarter with year-over-year growth of about 1.3%, in line with the previous quarter.

This marked a gain of 59,500 persons from the same quarter in 2016, pushing the provincial population to an estimated 4.79 million as of April 1, 2017.

Growth has tracked above 1.2% since mid-2016, maintaining a favourable pace compared with the post-2000 period and below only the pace observed from mid-2008 through 2009.

Net international migration, though modest, has been the primary contributor to population expansion with 33,830 net new residents over the past four quarters. While the bulk reflected landed immigrants, nearly a third were net non-permanent residents, which includes international students and people on work visas, as well as refugees and other groups.

While a smaller contributor to overall population gains, net interprovincial inflows have been a more substantial source of population growth in recent years. Quarterly net inflows decelerated in the first quarter from peak flows observed from mid-2015 through mid-2016, but stayed elevated and above previous cycle highs seen during the 2007-08 period.

Population growth is forecast to average 1.2% over the next two years as international migration climbs with the broader global economy and the elevated federal government intake of immigrants, but is expected to be offset by deceleration in interprovincial inflows. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.