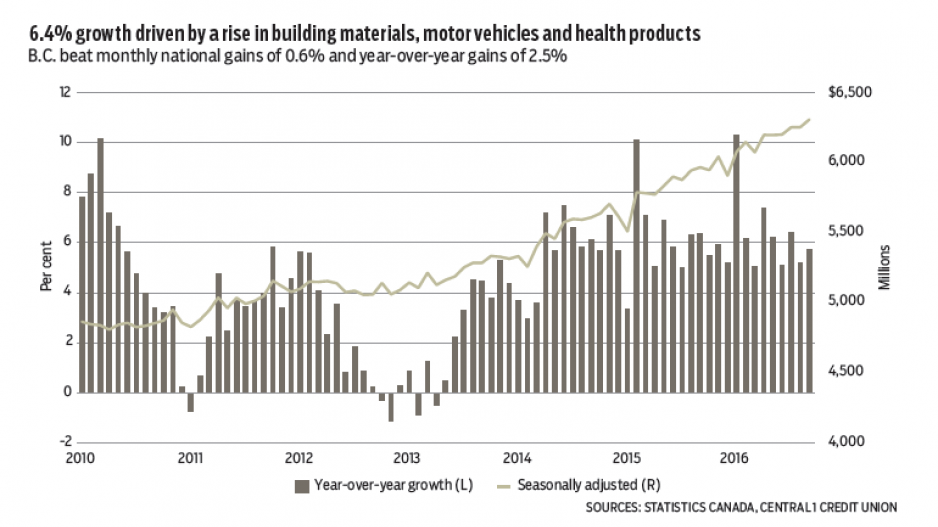

Following a steady August performance, retail spending in B.C. surged again in September on broad-based gains among retail segments. Dollar-volume sales climbed 0.9% from August to $6.31 billion, up 5.7% from the same month in 2015. B.C.’s gain outpaced a national monthly increase of 0.6%, and year-over-year gain of 2.5%.

Key retail store contributors included building materials/gardening, food and beverage, clothing and sporting goods stores.

Rising retail sales, which hit a year-to-date gain of 6.4% in current-dollar-volume terms and more than 5% in real terms after price inflation is considered, indicate strong consumer demand driven by employment gains, housing expansion, population growth and high levels of tourism. Excluding vehicle and gasoline sales, sales are up a similar 6.6% – a further confirmation of robust consumer demand.

Year-to-date growth has been driven by a rise in sales of building materials, motor vehicles and parts, health products and general merchandise retailers. Metro Vancouver has led growth with a 7.7% year-to-date gain.

We anticipate a downturn in the housing cycle from tighter mortgage insurance policies to slow momentum in related retail sectors such as home furnishing and electronics. Total retail sales growth is forecast to decelerate to 6% by year’s end, and climb by 5% in 2017.

On the wage front, average weekly earnings in B.C. edged up marginally from August to $921.43 in September, a gain of 1% from a year ago. National wages fell from August and were up 0.4% from a year ago, but largely reflected a contraction in Alberta.

B.C. average earnings continued to trend at a range-bound pace, despite a second straight month of growth, driving a year-to-date increase of less than 1% and ahead of only Canada’s energy-dependent provinces. This disappointing performance comes despite high job creation of 3.1% compared with 1% nationally. Among industries, goods-oriented sectors posted an aggregate year-to-date gain of only 0.3%, forestry rose 4%, utilities increased 3.4%, and manufacturing increased 1.8%. These were offset by about a 1% drop in the construction sector. Weekly earnings in services climbed 1.2%, led by a 6% increase in information and culture (which includes software) and more than 3.5% in the finance, insurance and real estate sectors.

Employment composition has contributed to weak growth. Resource extraction sectors have shed positions over the past year, although this was partly offset by construction jobs. •