"Above average" describes 2011 when it comes to the number and size of mega-mergers and acquisitions in B.C.

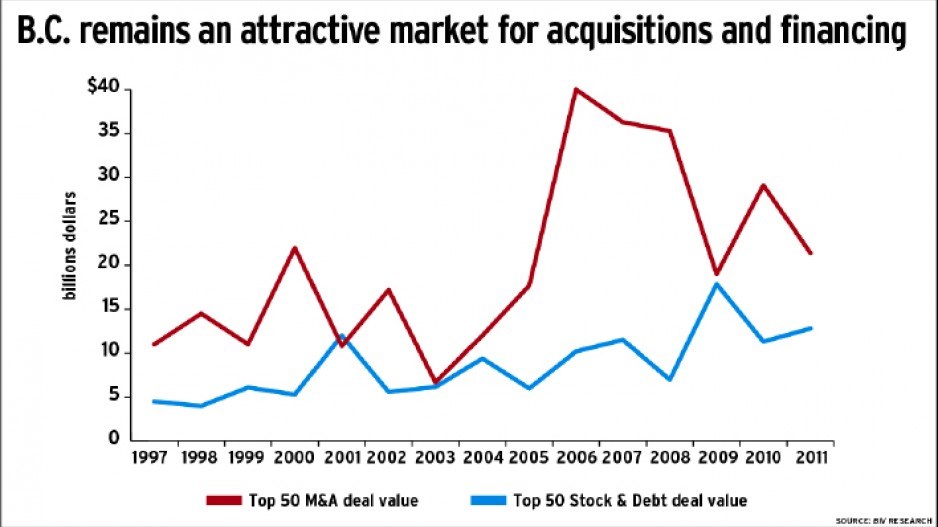

More than $21.4 billion in M&A deals was accumulated in the 50 largest deals involving B.C. companies last year. That's a significant drop from $29.1 billion of deals in 2010, but it was still above the 15-year average value of $20.3 billion of the top 50 B.C. deals over the past 15 years, according to BIV research.

From a value standpoint, what is notably missing in 2011 was a blockbuster mega-deal. Last year's largest deal was Walter Energy's $3.3 billion acquisition of Western Coal, which closed last April. While significant, the deal's value was less than half of the largest deals on the list since 2008.

Substantial stock market volatility and uncertainty in the bond markets because of concern over the Eurozone's debt crisis could be cited as one reason for the relative lack of mega-deal activity. For potential acquirers, market volatility likely hampered their ability to properly value a potential takeover target. (See "Opening up B.C.'s liquidity taps" – BIV issue 1161; January 24-30.)

But a PricewaterhouseCoopers (PwC) report suggests that the number of mega-deals in the province is becoming more limited by the relative lack of large companies based in the province. It noted that the size of deals made by B.C. acquirers has dropped to 6.9% of the total value of deals in Canada in 2011. That's down from 11.6% in 2000. Meanwhile, the value of M&A deals with a B.C.-based target rose to 16.1% of Canadian deals last year, up from 5% in 2000.

Nevertheless, B.C. remains an active M&A market. Lee Davis, managing director of PricewaterhouseCoopers Corporate Finance Inc., noted in a recent interview that both local and overseas corporate acquirers have increased their interest in potential takeover targets, not only in B.C. but all over the world.

Despite the market volatility, he said the total number of M&A deals in B.C. of roughly 900 transactions last year was on par with the volume of deals in 2010. And that was 50% more than the 600 deals that were announced in 2008, following the global financial crisis.

The PwC report also noted that 29% of the number of acquisitions by Canadian companies in 2011 involved a B.C. company, up from 15% in 2000. "Strategic companies are doing a lot of acquisitions," said Davis.

International interest in B.C. continued to widen last year with 20% of the biggest deals involving an international buyer, including Rio Tinto's growing stake in Ivanhoe Mines, (which grew to a majority interest in late January), and the mining giant's acquisition of Hathor Exploration, which closed last December.

China's focus on B.C.'s mining sector has continued with Jinchuan Group's $384 million acquisition of Continental Minerals last May.

Canadian-based pension funds remained active M&A players in B.C., with BC Investment Management Corp.'s acquisition of Calgary's Parkbridge Lifestyles Communities in January and Vancouver's TimberWest in July.

The province's private equity firms have also remained busy. Vancouver's Tricor Pacific Capital was involved in half a dozen deals last year that included a $40 million minority investment in Avison Young to help accelerate the company's aggressive expansion strategy.

Financing availability expected to tighten

Despite the market turmoil last year, large companies in B.C. did not have too much difficulty in obtaining financing. The total value of the biggest stock-and-debt deals by B.C.-based organizations rose to $12.8 billion from $11.3 billion in 2010.

The provincial government was among the larger financing recipients, raising $2.8 billion in three bond offerings last year. TransLink also tapped the market for a second year in a row, raising $200 million from the public markets.

Companies involved in the top 50 financing deals last year were among the relative few who didn't have too much difficulty tapping the public markets for capital. But, how open the liquidity taps remain is a persistent concern for 2012. A survey by the Canadian Financial Executives Research Foundation (CFERF) found that executives are expecting the availability of long-term financing to tighten this year, given the continued uncertainty over the effects of the European sovereign debt crisis.

Brian Allard, a partner at Ernst and Young's transaction advisory services, noted smaller companies continue to face challenges in obtaining financing given that most lenders remain relatively conservative and risk-averse. Smaller public companies face the most difficult challenges, given choppy and unpredictable equity markets.

Nevertheless, Allard suggested companies of all sizes have more options available to them, including the high-yield debt markets, where companies can raise capital by issuing non-investment grade bonds. The high-yield market in Canada has become one of the fastest-growing financing vehicles in the past few years. According to DBRS, the market has grown to nearly $5 billion in 2011 from $1.2 billion in 2009.

Institutional investors like mutual funds have become attracted to the high-yield market because of its higher rate of return compared to traditional fixed-income investments with much lower returns due to record low interest rates in Canada.

Because of increased market volatility in both the equity and bond markets, Allard noted, more companies are planning earlier to raise capital rather than wait until they have an immediate need.

This desire is reflected in the CFERF survey that found that nearly 70% of executive respondents were planning to obtain a line of credit or obtain capital by offering medium-term notes. About 28% were looking to make a private debt offering and 27% were planning a private placement of equity.

Companies have also been tapping markets to reduce their costs of capital. Telus, for example, has spent the past few years issuing cheaper debt to replace US$2 billion in 10-year bonds that was raised as part of a $6.7 billion bond offering associated with its acquisition of Clearnet Communications in 2000.

"Successful companies are seeing financing as a process and not as an event now," said Allard. "It's one of the things people learned from the financial crisis. They don't wait to acquire capital; they look at the availability and pricing in the credit markets and go to the markets in anticipation of needs down the road."

While the markets remain volatile, Allard noted, "What we're seeing right now is very attractive credit markets in terms of the overall cost of financing." •