A Vancouver economist is arguing that Canada’s tax system is in serious need of reform to rein in growing income inequality and spur investment in the economy.

“I’m concerned about growing inequality and increasing income concentration, but I know that not everyone shares that concern,” Kevin Milligan, a professor at the University of British Columbia, told Business in Vancouver.

“The goal here is for me to convince people who are even eat-what-you kill capitalists that it’s important for them too.”

In a report published November 26 by the C.D. Howe Institute, Milligan calls for several changes, including taxing stock options as income; getting rid of various “boutique” tax credits such as the Children’s Fitness Tax Credit; and changing the way corporate income is taxed so that dividend and capital gains are taxed at a simpler, flat rate.

Milligan believes that increasing tax on top earner’s compensation and lowering tax on investment will achieve tax fairness. He argues that more investment in the economy will be needed in the next 25 years as growing sectors like technology continue to surpass Canada’s traditional resource industries.

“If you want to have that economy that encourages growth, innovation and investment, the way you’re going to get there is not by yelling at people who care about equality,” he said.

“It’s by recognizing that they have legitimate concerns and saying look, we’re willing to make some trade-offs to get that innovation and growth. We’re going to have that on the investment side, but we’re going to tax a bit more tightly those on the employment income side.”

For over a decade, economists have recognized that income inequality has been growing, but the issue broke into public consciousness this year with the English-language publication of economist Thomas Piketty’s book on the subject, Capital in the Twenty-First Century.

Using income tax data from several countries over the 20th century, that book documented how incomes became more equal after the Second World War thanks to a combination of high tax rates, high economic growth and the after-effect of two world wars. In the past two decades, income inequality has risen to rates not seen since the First World War.

While income inequality in Canada has not risen as quickly as in the United States, it is a concern, Milligan said. The rise of “supermanagers” — highly-paid executives and managers — is one of the main reasons income concentration has grown. Those high earners also tend to be adept at using the tax system to their advantage.

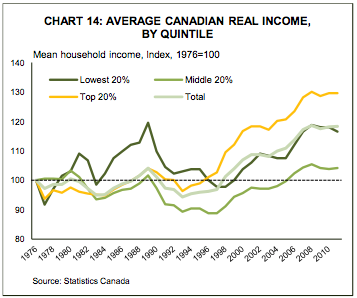

“What you see is, over the last 30 years [in Canada], people in the top 0.01%, their income growth has been 150% over this period,” Milligan said. “People in the bottom 90%, they’ve experienced 8% growth.”

Source: Kevin Milligan, Tax Policy for a New Era: Promoting Growth and Economic Fairness

@jenstden