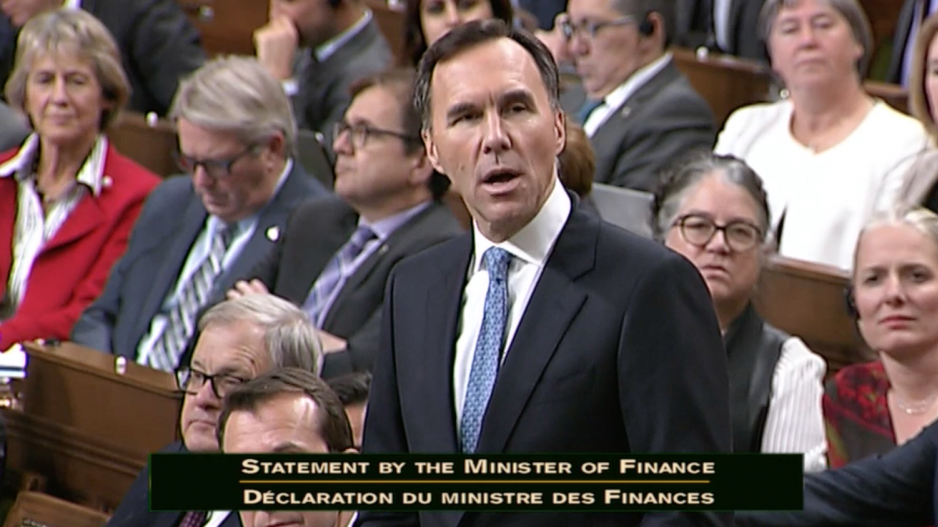

Federal Finance Minister Bill Morneau gave his annual fall economic update on the floor of parliament November 21, highlighting how the government would respond to massive tax changes undertaken by the U.S. late last year.

Morneau first acknowledged that as a sovereign nation, the U.S. had the right to change their tax policies as they see fit. He said that the government would not match U.S. tax changes, citing the debt increases that would inevitably follow.

However, despite not matching the U.S. tax cuts, Morneau announced that the federal government would be accelerating investment incentives by making changes to the capital cost allowance. He said the changes would permit all businesses to write off equipment purchases and capital expenses quicker than previously allowed. Morneau also announced a special deduction for manufacturing and processing businesses allowing them to write off equipment purchases immediately.

This immediate write off would also apply to green energy equipment, seemingly addressing opposition criticism that the carbon tax is punitive rather than incentivizing.

Accelerating the capital cost allowance is a more targeted and inexpensive measure that would have less of an impact on tax revenue than simply lowering the corporate tax rate. Instead of giving businesses a deduction spread over multiple years, the deduction would be front-loaded, and companies could reap an immediate benefit for investing while not reducing tax revenue in the long run.

Rather than rewarding all businesses with lower taxes, the government, by focusing on deducting assets like equipment, would reward only businesses that make the decision to invest in Canada rather than the U.S.

Prior to America’s federal tax changes, Canada had a more than 12.8% advantage in its average effective corporate tax rate over the U.S., after taking into account credits and deductions that reduce a corporation’s tax liability. According to a March 2017 U.S. Congressional Budget Office (CBO) report, Canada had the third-lowest average corporate rate in the G20 at 16.2%, behind Germany and the U.K., based on information from 2012.

The U.S., on the other hand, had an average corporate tax rate of 29%, third highest in the G20. While the CBO did not have a comparable post-Trump tax cuts number, a Penn Wharton study found that the average corporate tax rate in 2018 would be 9.2%, climbing up to 17.3% by 2023. That study calculated the 2017 U.S. average effective corporate tax rate to be 21.2%, almost eight percentage points lower than the CBO’s calculation of the rate before the cuts.

A large portion of the announcement was used to outline what Morneau considers to be economic successes of the government. At the beginning of the announcement, Morneau took credit for the current state of the economy, citing the new North American trade agreement, major private sector investment and changes to personal tax rates the government made in 2017.

While touting the success his government has had signing trade agreements across the globe, being the only G7 member to have agreements with all other members, Morneau said he would work with his provincial and territorial counter parts to remove barriers to intraprovincial trade. Specifically, Morneau pointed to facilitating greater alcohol trade as well as harmonizing food and construction regulations across the province.

During the announcement, Morneau also highlighted concerns from the country's oil and gas industry about the growing price gap that exits between U.S. and Canadian oil.

Morneau also outlined $17.6 billion in new measures including $800 million over five years for a strategic innovation fund including $100 million for the forestry sector.

Despite election promises by the Trudeau Liberals to bring the federal budget to balance by the year 2019, the budget deficit increased 10.1% growing to $19.6 billion in 2019 from a projected $17.8 billion. The debt is expected grow by 96.7 billion to $765 billion by 2023 however with GDP growing faster than expected the Debt-to-GDP ratio is projected to fall each year to 28.5% by 2023.

Canada has been one of the economic growth leaders in the G7 at 2.4%, only 0.1% behind the U.S. and nearly double the growth of both Japan and Italy.

Part of the deficit increase comes from a $595 million commitment towards the Canadian news media industry. The money will take the form of a refundable tax credit to support labour costs associated with producing news content as well as a 15% tax credit for qualifying subscribers of eligible digital news media. The biggest change, however, is extending access to charitable tax incentives to the news media industry, including the ability for people to deduct donations made to news organizations similar to the way that charitable donations are deducted.

In a surprising move the government also announced what it calls an Annual Regulatory Modernization Bill, which aims to remove regulations that the government deems to be outdated, essentially implementing a form of an annual sunset clause on Canadian regulation.