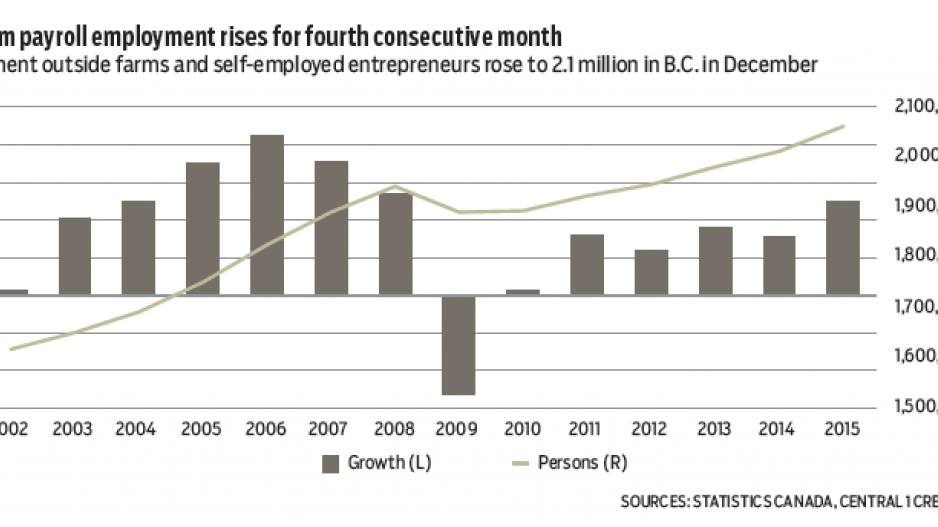

B.C.'s favourable economic position among provinces was underscored again in average weekly earnings and non-farm payroll employment data, but lower confidence readings speak to caution on the part of businesses.

Average weekly earnings estimates from Statistics Canada’s survey of employers showed a solid gain in December pushing levels well above a recent range-bound trend. Weekly earnings climbed by 1.6% from November to a seasonally adjusted $921, up 2.9% from a year ago. This outpaced the national gain of 0.9%, month-over-month, and 1.7%, year-over-year, which was dampened by weaker growth in the Prairies.

B.C. remained below the national average of $959 despite stronger growth. Industry composition is a key contributor to these differences; provinces geared more to energy and mining, despite current challenges, still post higher average earnings. Among provinces, Alberta topped the country at $1,147, followed by Newfoundland and Labrador at $1,036.

While numerous factors influence earnings, including wage growth, industry composition and hours worked each week, most B.C. industries saw higher earnings from November, suggesting a lift from broader economic growth.

Year-over-year gains were led by 14% increases in forestry and arts/entertainment/recreation, 7.1% in manufacturing and 10% in management of companies. In contrast, there remains a downward trend in mining and energy resources (-7.4%) and utilities (-4.8%).

The Canadian Federation of Independent Business’ Business Barometer showed another slip in B.C. small-business confidence in February, but B.C. remained broadly in line with most other provinces outside Canada’s key energy producers. Despite strength among B.C. economic indicators and expectations for moderate economic growth, caution reflects global economic unease and the pummelling of the loonie, which has raised costs for imported goods.

B.C.’s confidence reading in February fell to 61.1 points on a scale of one to 100, down from 62.8 points in January and down nearly eight points from a year ago. Nationally, the reading was 54.7 points. A reading above 50 means that the number of businesses expecting their business performance to be stronger over the next year exceeds those with a negative outlook. Barometer levels suggest B.C. businesses are growing less confident than they have been on average in the past, which could lead to caution on the investment and hiring fronts. •

Bryan Yu is senior economist at Central 1 Credit Union.