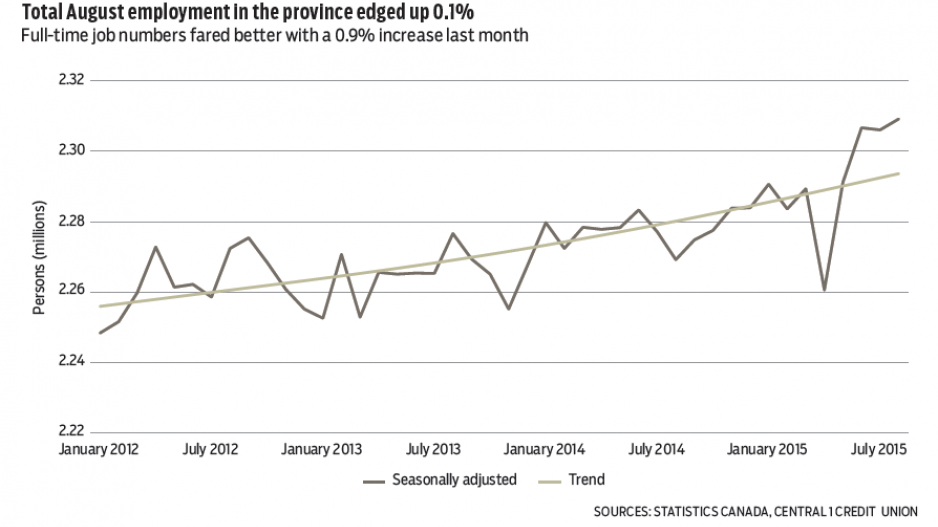

The August Labour Force Survey (LFS) results for British Columbia showed little change from the previous month and a modest advance in underlying trends. Total employment edged up 0.1% or 3,100 persons. The unemployment rate held steady at 6%.

The 16,900-person increase (0.9%) in full-time employment in August was offset by a similar-sized drop in July, returning it to June’s level. However, full-time employment has risen every year since the recession with 2015 on track to be the best performer.

The noticeable upshift in employment in May and June was accompanied and likely driven by comparable increases in the labour force, causing the participation rate to edge higher. This may or may not be significant because of sampling error, and we need future data to validate this trend. For example, in 2011 the participation rate rose for seven months before turning lower through to early 2015.

The declining participation rate not only in B.C. but also in Canada and the U.S. since the recession is of keen interest to economists. Is it due to aging demographics or to a lack of labour demand that is unable to attract workers into the labour force? Research identifies that both forces are at play with more weight currently given to demographics than demand deficiency.

Our forecast takes the position that there will be modest rises in the participation rate and in labour force growth when the B.C. economy generates more labour demand starting next year. Without an increase in labour supply, lower unemployment rates and more upward pressure on wages would result.

Our forecast has the unemployment rate declining to 5.5% in 2017 accompanied by faster labour force growth, but should the participation rate continue to decline, the unemployment rate would fall to less than 5%.

Meanwhile, international merchandise exports from B.C. are gaining some traction despite weaker economic conditions in Asian markets. Total dollar value of seasonally adjusted exports edged up 1% in July over June and has risen since February.

So far this year exports are up 0.9% over the same period last year.

Exports to Pacific Rim countries are down 3.9% while exports to the U.S. are up 4.5%. With the low loonie and the outlook for the U.S. economy brighter than for the Pacific Rim economies, exports to the U.S. will rise and continue to offset weakness elsewhere. •

Helmut Pastrick is chief economist for Central 1 Credit Union.