B.C.'s surging labour market took a breather in July as employment slipped for the first time since November and unemployment rose.

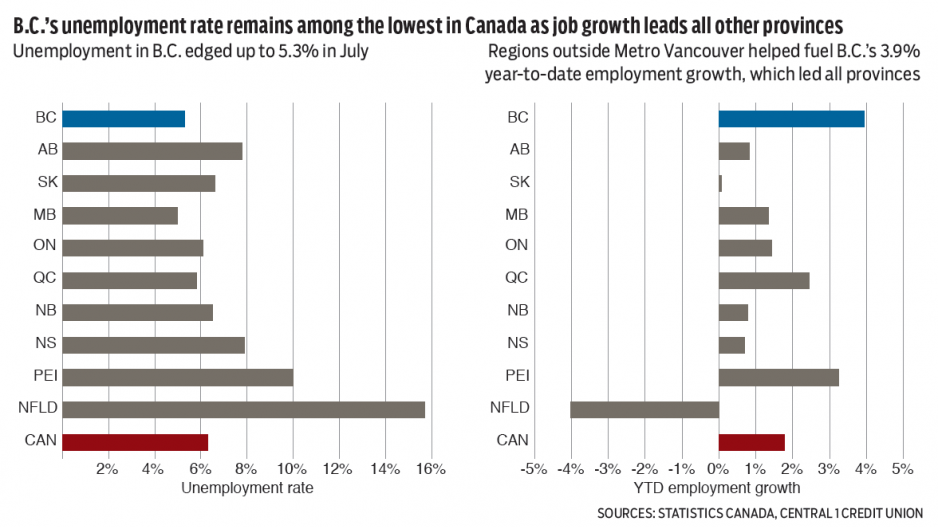

Led by a 0.4% decline in Metro Vancouver, employment fell 0.2% (or 5,100 persons) from June compared with a mild national uptick of 0.1%. That said, the headline decline does not signal a labour market turn. More important is the trend, which remained on a strong upward path driven by economic expansion, specifically in housing construction, tourism, consumer demand and high-tech sectors. While decelerating from June, year-over-year employment growth again led the country at 3.6%, with year-to-date growth a phenomenal 3.9% led by regions outside Metro Vancouver. Job quality trends are positive with year-to-date full-time employment growth of 4.2% and rising hours worked in the economy.

While unemployment edged higher to 5.3% and has generally been range-bound this year, levels are tracking with Manitoba for lowest in the country. Annual employment growth is forecast to average 3.5%, with a 5.2% unemployment rate.

Housing market conditions in the Metro Vancouver/Abbotsford-Mission area remained strong in July as prices continued to rise, but softer sales suggest affordability erosion, tightening credit conditions and policy uncertainty related to the new provincial government may be curtailing the sales cycle.

Seasonally adjusted sales continued to moderate from May’s peak, but remained high by historical comparison, with levels 15% above the 10-year average. The 5.8% year-over-year sales decline largely reflected stronger activity a year ago.

The market for detached homes remains relatively soft. Sales are 40% below the early 2016 peak, while demand for apartments and townhomes has surged. The foreign buyer tax continues to weigh on detached and luxury home sales, while demand for condos remains firm due to a strong labour market, low interest rates and a lift from the B.C. Home Partnership Plan.

Rising prices are leading to more new listings but not enough to make a material dent in near-record low inventory and market tightness.

The MLS® housing price index (HPI) for apartment and townhomes jumped 3% from June, with detached homes up 2%. Year-ago HPI growth for apartments was 21%, with townhomes at 14% and detached homes at 4.5%. Multi-family product remains the affordable alternative, but even those units are quickly moving out of reach for many buyers. •

Bryan Yu is deputy chief economist at Central 1 Credit Union.