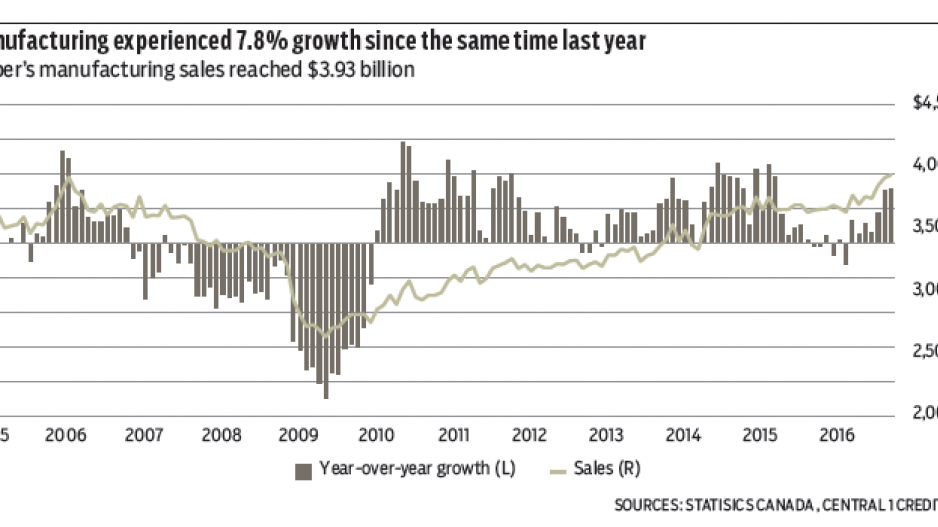

B.C. manufacturers added to momentum in September with monthly sales growth of 0.6% to reach a seasonally adjusted $3.93 billion, outpacing national gains for a third straight month. Increased production in food manufacturing, aerospace parts and equipment, fabricated metals and paper manufacturing were partly offset by dips in wood products and primary metals.

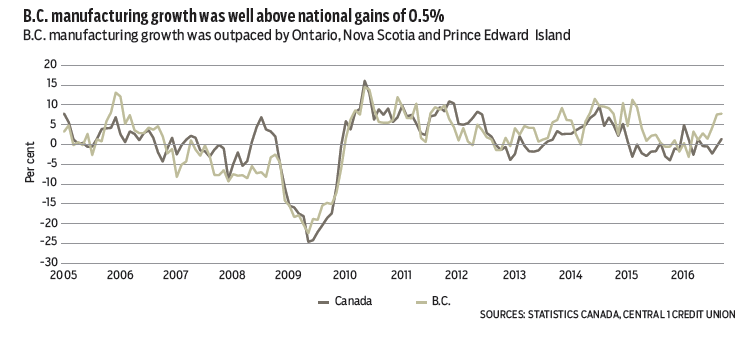

Robust year-over-year growth of 7.8% lifted year-to-date growth to a solid 3.1%. B.C. growth was well above a national gain of 0.5% but was exceeded by Ontario at 5%, and Nova Scotia and Prince Edward Island at above 4%.

Year-to-date information sheds better light on high- and low-growth sectors given monthly fluctuations. Export-oriented demand has underpinned much of the gains. Significant contributors to overall growth included food products, which rose 4.1%, driven by beverage sales, and seafood, as well as sawmill production, which gained 11% from a year ago, led by U.S. export demand, and primary metals manufacturing. Shipbuilding was also a strong contributor with a 25% gain, which could reflect federal contracts. In contrast, paper and pulp production fell 13%.

A low Canadian dollar and improving U.S. economy will underpin demand for B.C. manufacturing products, although wood products are a risk to growth given the absence of a new softwood lumber agreement and likelihood of punitive tariffs.

B.C. consumer price growth picked up in October with broad-based acceleration across most goods and services purchased. Year-over-year growth in the consumer price index (CPI) climbed to 2.1%, up from 1.8% in September. In comparison, headline national growth reached 1.5%.

October’s increase primarily reflected an increase in price levels compared to September. Factoring out seasonality, monthly prices rose 0.3%, after a flat reading the previous month.

While still moderate, recent inflationary pressure has been more than B.C. residents have been accustomed to over the past two years. A 7.2% increase in gasoline prices was a significant but not the only driver. Shelter costs climbed 2.1%, driven by an increase in homeowner replacement costs and maintenance and repairs. Higher import prices have also contributed, as purchase and leasing of vehicles rose 4.7% and recreation and reading climbed by 3.1%. In contrast, clothing and footwear prices were down 0.8%. •