Profit growth has continued to be a challenge for Canada's insurance brokerage industry.

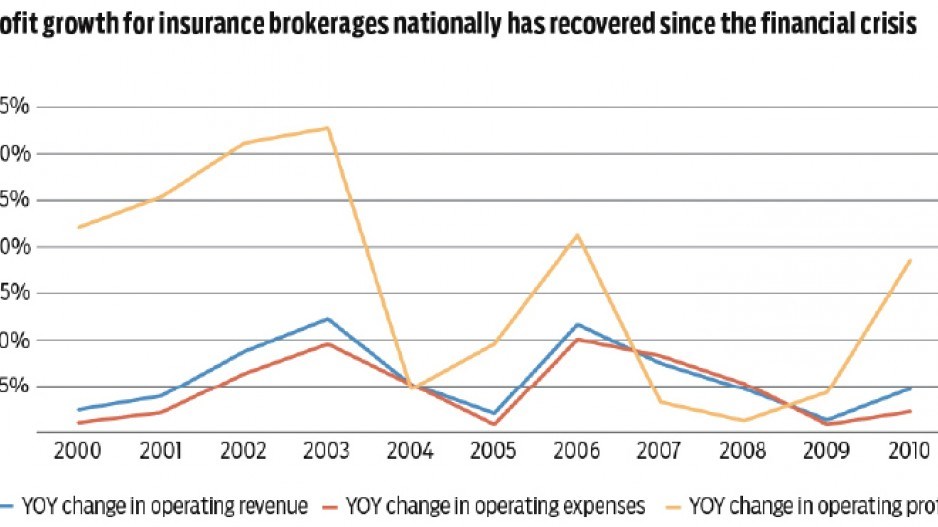

According to Statistics Canada data, year-over-year operating profit growth for insurance agencies, brokerages and related services has fluctuated widely in the past decade from an annual peak of 32.8% in 2003 to a low of 1.2% in 2008.

Fluctuations in global insurance costs are a key challenge for brokers. Costs spiked in 2006, rising nearly 25% followed by a further 10.3% in 2007. By comparison, wage, salary and benefits expenses rose 2.6% in 2006 and 7.3% in 2007.

Despite the challenges, the industry continues to grow in Canada. According to StatsCan, operating revenue rose 82% between 2000 and 2010 to $10.6 billion. Operating profits jumped nearly four-fold to $1.8 billion in 2010 from $468 million in 2000.

Since the global financial crisis, profitability growth has improved, rising 18.5% in 2010. Consolidation and productivity gains have been cited as key reasons for the improvements.

A survey conducted by Mike Berris, formerly with Berris Mangan (which merged with KPMG Enterprise last year), found greater economies of scale, more effective technology and more streamlined management associated with larger organizations contributed to improved efficiency.

Greater scale has also helped them stay relevant with clients by allowing organizations to source the correct coverage at the right price, help customers with claim management and provide expert advice in all aspects of risk management.

As a result, the report noted that the top 40% of the market earns 75% of the industry's profits.

Commercial insurance appears to be the sweet spot for larger firms. The report noted that 27% of brokerages with more than $1 million in revenue earned their revenue from commercial insurance lines. By comparison, small and medium-sized brokerages with revenue under a million sourced their sales primarily from automotive and personal lines of insurance. •