Struggling B.C. CEOs should be on guard if cash-rich hedge funds come knocking.

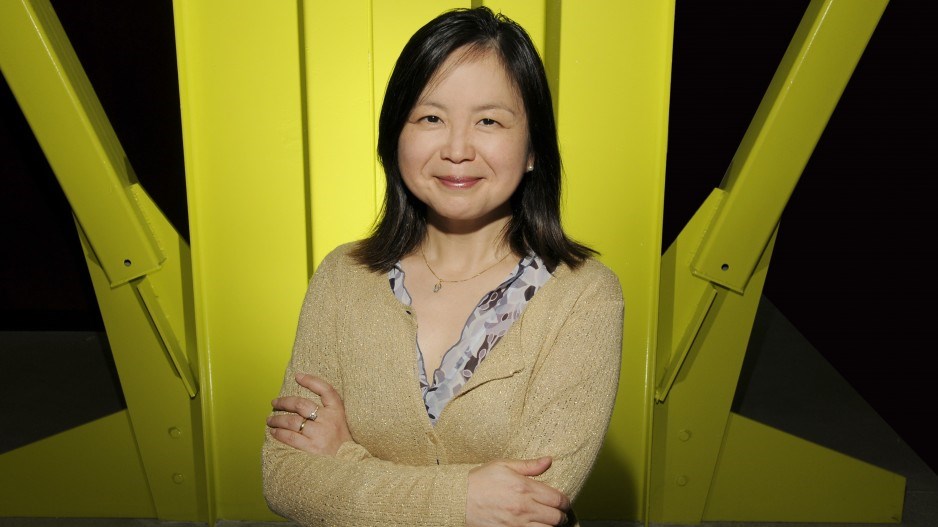

A study co-authored by Kai Li of UBC's Sauder School of Business found that CEOs of distressed companies are far more likely to lose their jobs if hedge funds became key investors or creditors.

The study published in the Journal of Finance looked at 474 bankruptcy filings in the U.S. from 1996 to 2007 and found that in nearly 90% of the cases hedge funds were involved.

About 27% of the CEOs were forced out of the company compared with under 10% in other distressed situations that involved no hedge fund investors.

"Hedge funds are very forceful in firing failed leaders," said Li.

While Canadian firms were not included in the study, prominent CEOs of B.C.'s largest companies have faced the same fate in recent years.

- The Ainsworth family lost control of Ainsworth Lumber (TSX:ANS) back in 2008 in a US$1.2 billion restructuring that involved swapping US$824 million of debt for new equity when the company became overburdened with debt. Dallas-based hedge fund HBK Investments was a key creditor involved in the deal.

- Bill Hunter of Vancouver's Angiotech Pharmaceuticals was ousted last year from the company he founded following a $250 million recapitalization deal that involved New York-based Blue Mountain Capital Management.

- And just last week, John Greenslade, founder and CEO of Baja Mining Corp. (TSX:BAJ) resigned after a proxy battle with New York's Mount Kellett Capital Management.

While chief executives are more likely to get the boot, other executives did not necessarily share the same fate. Li's study, co-authored with researchers from Columbia and Queens universities, found that hedge fund investors are not as "anti-management" as generally thought. Even in the most distressed situations, hedge funds were keen to keep key personnel with lucrative retention plans to help them improve the company's fortunes and, ultimately, provide a solid return for the fund.

The study found hedge fund involvement ultimately led to a higher chance of surviving the bankruptcy process, better debt investment recovery and stronger share prices for publicly traded companies after restructuring. It consequently downplayed the public persona of hedge funds as "vulture" investors looking to dismantle companies to make a quick buck in a short time.

Short-term opportunistic hedge funds exist. Telus (TSX:T) has been a recent target of Mason Capital over the telecom giant's plan to merge its two classes of publicly traded shares.

Because hedge funds have historically been less regulated than other investments, it's difficult to gauge the size of the global hedge fund market. Estimates of global hedge fund assets under management range between $1.6 trillion and $2 trillion, with the bulk of those investments managed by U.S.-based firms. Anywhere from 15% to 20% of the hedge funds in North America could be as benevolent and long-term focused as those covered in Li's study. An equal proportion could also be opportunistic. But most of the hedge fund market focuses on other investment strategies.

While CEOs might take it on the chin, investors ultimately benefit from hedge fund involvement.

Peter Klein, an SFU finance professor and advising principal of KCS Fund Strategies, noted that hedge funds in Canada have consistently outperformed the market since 2004, even after the massive declines in late 2008. Being pushy, vocal, activist investors is a key contributor to their performance.

While Klein couldn't comment about the Telus case or the battle that led to the resignation of Canadian Pacific CEO Fred Green, he noted that hedge funds are playing a key role in ensuring executives are doing their best to maximize returns for investors.

"With what's going on with CP right now, I would have thought that would be a good influence," said Klein. "It keeps company executives on their toes." •