Over the past year, Central 1 Credit Union has cautioned that B.C.’s solid economic performance masks divergent sector trends, which translates into a bifurcation in regional economic strength.

On the one hand, low interest rates and the low Canadian dollar are lifting tourism, housing market strength and non-commodity goods and services exports. In contrast, the severe and broad slump in resource prices, including copper, coal, natural gas and oil, has pummelled base metal and material exploration, mine activity and natural gas investment.

Low oil prices and job cuts in the Athabasca oilsands have affected B.C. markets, both directly and indirectly. Individuals residing in B.C. but working in the Alberta oilpatch have experienced job losses, while lower consumer confidence in Alberta is likely limiting tourist visits and purchases of secondary and recreational housing in the B.C. Interior.

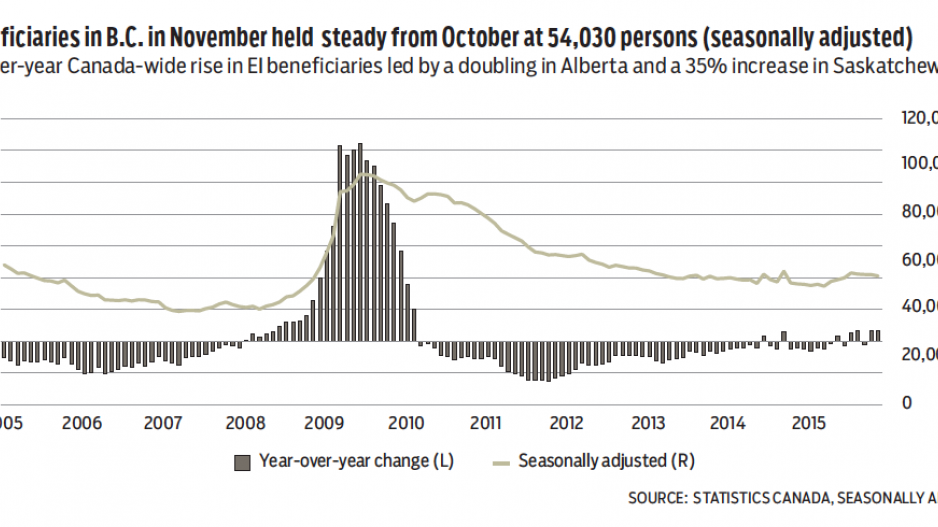

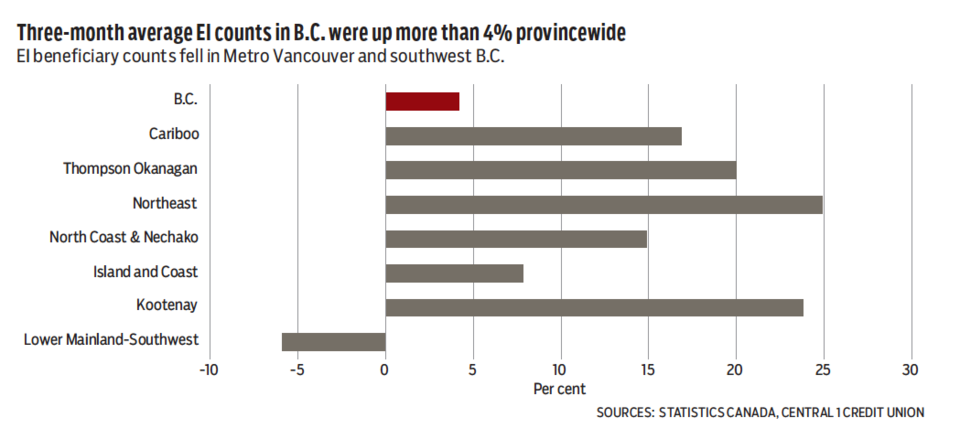

This economic divergence among regions is evident in the trend of employment insurance (EI) beneficiaries. For the most part, the number of EI beneficiaries in B.C. remains low. The number of EI beneficiaries in November was steady from October at 54,030 persons (seasonally adjusted), which was up 6.5% from a year ago. In comparison, EI figures were up 9% across Canada, led by a doubling in Alberta and a 35% increase in Saskatchewan. In B.C., EI counts fell from a year ago in the region’s economic growth engine of the Lower Mainland–Southwest, which has experienced strong economic and job growth over the past year. Three-month average EI counts were down 5.9% in November from a year ago.

In contrast, labour market challenges have mounted in the north, Interior and Kootenay areas of the province. Average EI counts were up more than 20% in the Northeast, Thompson-Okanagan and Kootenay regions, and up about 17% in the Cariboo. These areas are facing the headwinds of low commodity prices and weaker Alberta demand. Elsewhere, the Vancouver Island and Coast region has seen modest increases of about 8% from a year ago.

The key lesson from the EI report is that B.C.’s solid growth trend needs to be viewed through a regional lens. While the Metro Vancouver area leads growth, global pressures are a significant challenge for other regions that will continue through 2016.•

Bryan Yu is senior economist at Central 1 Credit Union.